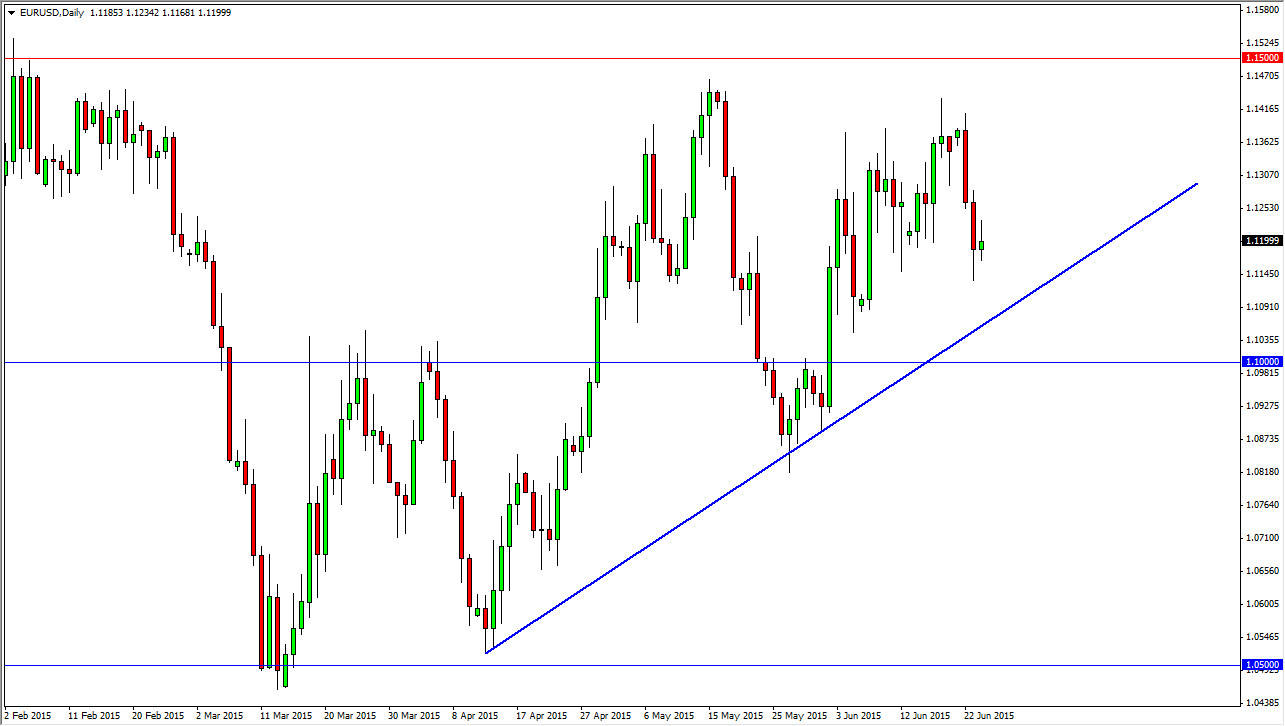

The EUR/USD pair initially tried to rally during the session on Wednesday, but found enough resistance near the 1.1250 level that it turned back around to form a bit of a shooting star. However, even though this is a relatively negative looking candle, the reality is that we had fallen rather significantly the previous 2 sessions. The fact that we really didn’t break down during the session on Wednesday tells me that the buyers are starting to get interested again, and I have a couple of reasons to believe that support is just below.

There is an uptrend line that is sitting it currently just below where we are at, and of course there is the round number of 1.10 that is just below that. With both of those being in play, I think that it is going to be very difficult for this pair to break down in the short-term. On top of that, think about what is making this pair selloff: rumors and fears out of Athens. We’ve seen this move before, and quite frankly I’m not impressed.

There will be some type of deal

There is no way in the world that the Greeks are going to leave the European Union. It would be absolutely devastating financially, and as a result cooler heads will prevail. The last thing that the Europeans want is some type of massive default, so they are doing a bit of posturing as well. This market has been rising for a while, and I believe that it is the so-called “smart money” getting into the Euro as it is way undervalued at this point in time. After all, we are starting to see signs of life in the European economy, and this nonsense out of Athens pops up about every 6 months. The reality is something will have to be done in a long-term, but the way they are playing this out it will be over the course of several years, and very slowly. Those who pull strings from behind the scenes know what they’re doing, they are simply letting this problem bleed slowly. I am a buyer on short-term supportive candles.