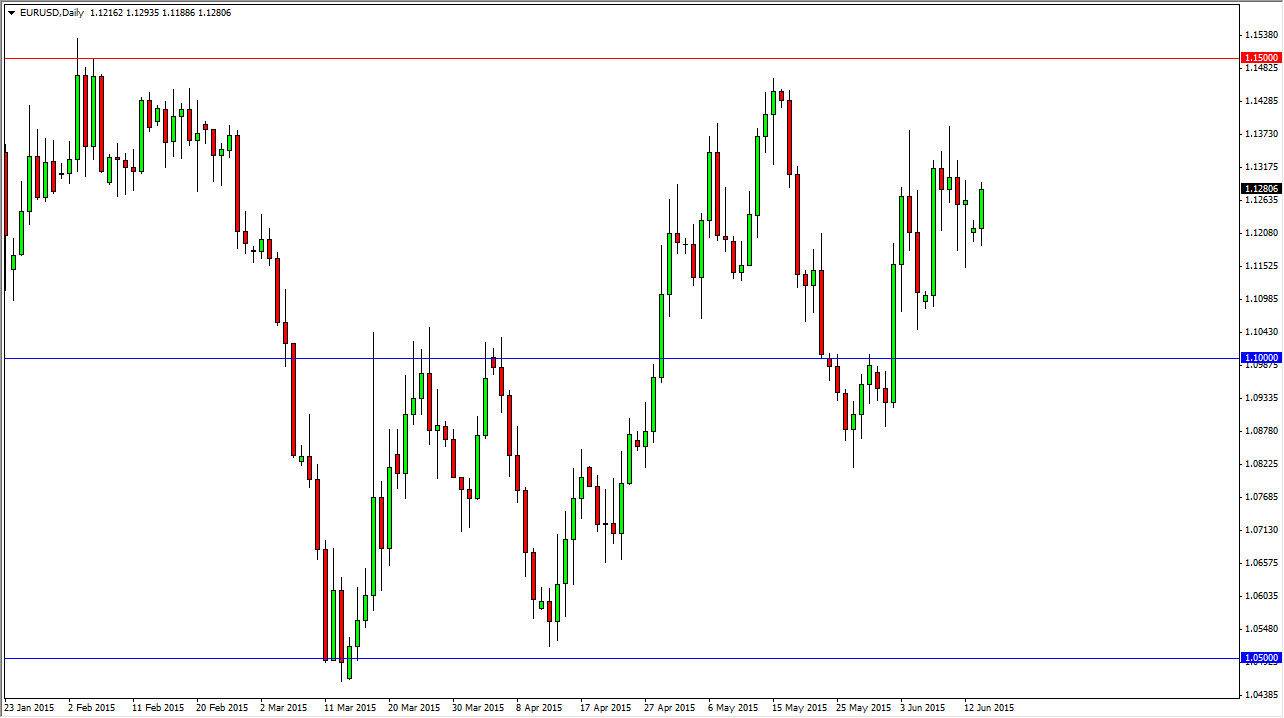

Looking at the EUR/USD pair, you can see that we gapped lower at the open on Monday but found enough support near the 1.12 level to turn things back around and form a fairly positive candle. By completing this move, it looks like the market is going to head back to the 1.14 level, an area that I see as rather resistive. This resistance will eventually break to the upside, but we may need to make several attempts to get above it. On top of that, I am a bit leery of owning the Euro above the 1.14 level until we clear the psychologically significant and technically significant 1.15 handle. Above there, I believe that the Euro continues to go much higher and it becomes more or less a “buy and hold” type of market.

Buying dips

I continue to buy dips in this market and I believe that most of the market participants will as well. After all, this is a market that looks like it is starting to turn the corner so speak, and the most recent low of course has been higher than the one before it. I believe that the Euro has been oversold, and while I’m not necessarily excited about owning the Euro, I recognize that it is in fact value down here. After all, unless of course you believe that the European Union is going to completely dissolve, we are probably well oversold at this point in time.

Keep in mind that the Greek debt talks continue to cause all kinds of drama, but quite frankly I believe that creates a short-term buying opportunities as the market continues to overreact in general. With this, I think that we eventually break out, and then will probably begin a multi-year uptrend once we get above the 1.15 handle as I think we will then first try to get to the 1.18 level which was significant support previously, and should now be resistance. Once we get above there, I believe that we go to the 1.20 level, the 1.25 level, and so on.