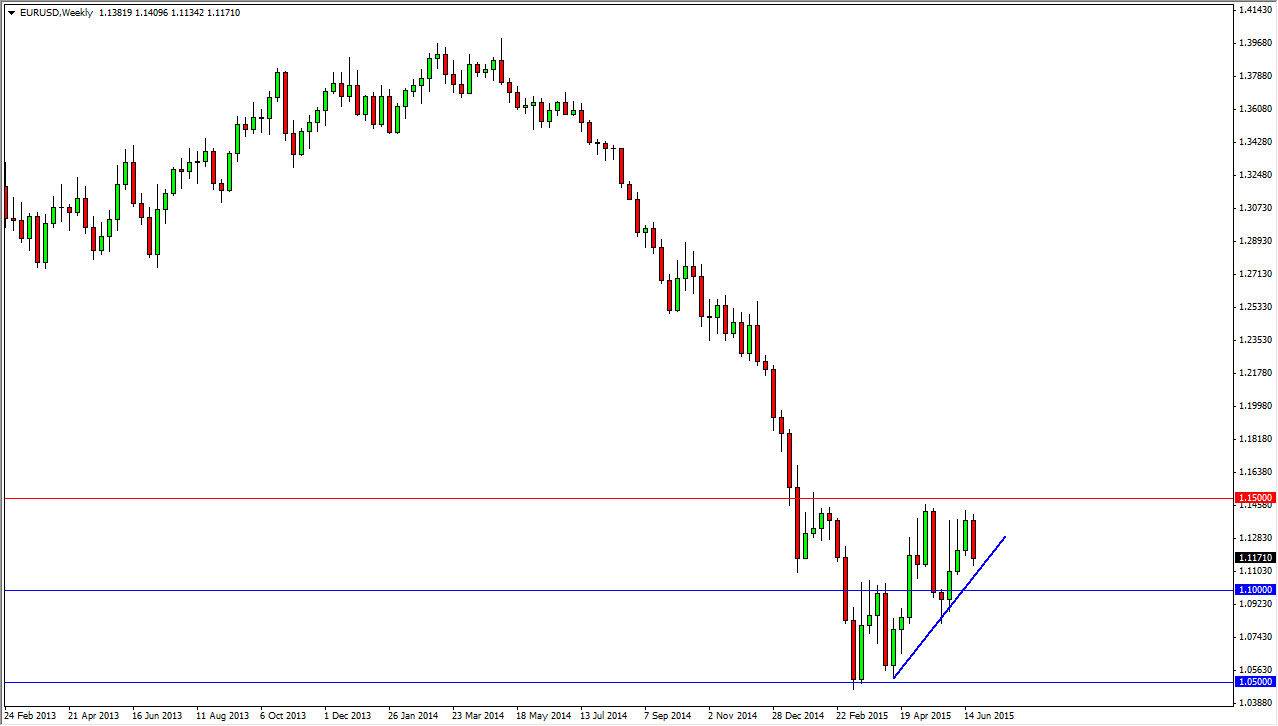

The EUR/USD pair spent most of the month going higher during June, but as you can see on the chart the last week fell back as the Euro cools off a little bit. The European Union continues to be an area that has a lot of issues, especially when it comes to Greece. However, in the end I believe that we are trying to build up enough momentum to break out to the upside. I still believe that the 1.15 level is massive in its implications, and as a result if we can break above there I believe that we will more than likely head towards the 1.25 level next. I also believe at that point in time the trend will have changed, and the Euro would be a currency that owning it becomes possible again.

I believe that the issues in Greece will pass yet again, and eventually we will either get some type of deal, or a short-term fix of that will have traders by and the EUR/USD pair yet again. I also have an up trending line on the chart that shows that the buyers have been very active, and at this point in time even if that gets broken, I still think there is massive support below.

The 1.10 level is massive

I believe that the 1.10 level below is of course massive in its implications, as it should be essentially the “floor” in this market. Because of this, I think that buying pullbacks should be the way going forward, just as the aforementioned break out above the 1.15 level would be also. Quite frankly this is a marketplace that has very few people left to sell, as all of the money has been made by the sellers by now. Truthfully this point in time you have to wonder who’s left to sell this market? Ultimately though, we may get a bit of choppiness this month, as it is the middle of the summer. However, I do believe that we more than likely have seen the bottom.