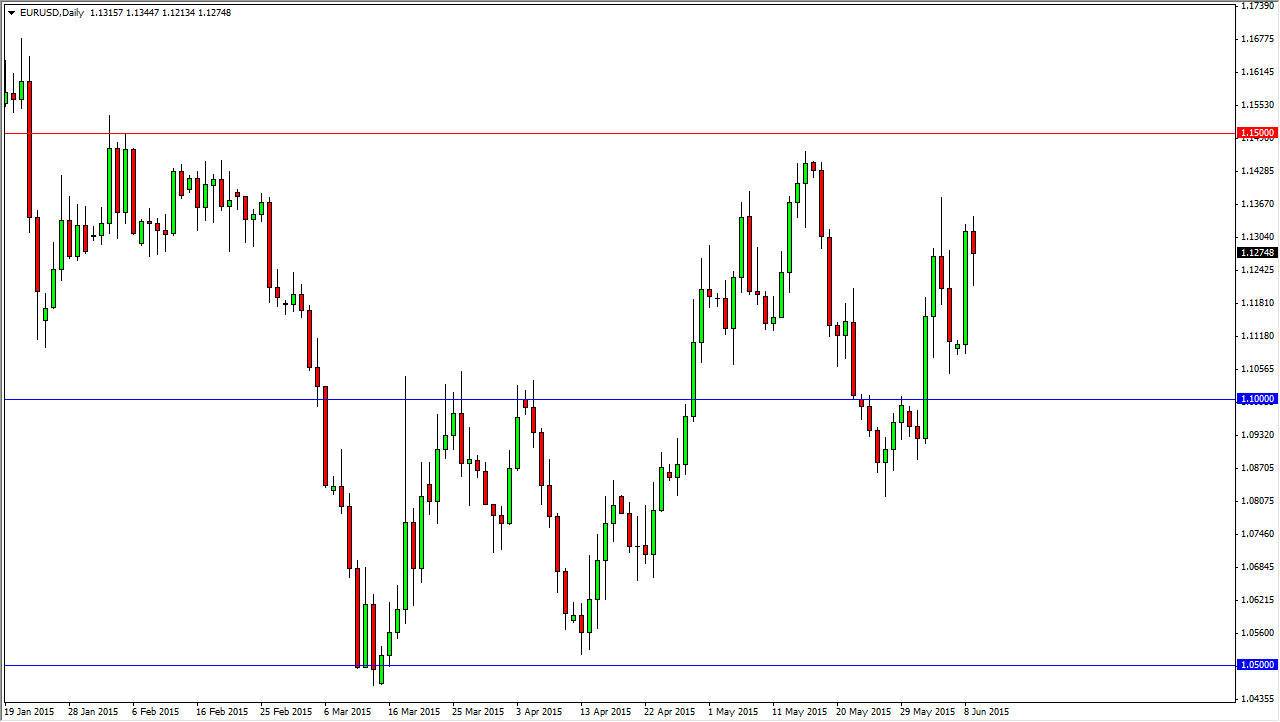

The EUR/USD pair initially fell during the day on Tuesday, but found enough support near the 1.12 level to turn things back around and show quite a bit of resilience. The resulting candle is a bit of a hammer, so I think that this market is ready to go higher but I also recognize that there is a lot of resistance above. I think the resistance extends from the 1.14 level all the way to the 1.15 level. However, looking at this chart I cannot deny that all of a sudden the Euro looks like the currency du jour, as it seems to be strengthening against just about everything out there.

Because of this, I am bullish of this pair but I recognize that we will have to build up enough momentum to finally break above the red line on the chart, the 1.15 level. If we get above there, I feel that the trend has changed completely, and we will continue to go much higher over the longer term.

Federal Reserve, one and done?

There is a growing acceptance of the fact that the Federal Reserve is going to raise interest rates this year. However, a lot of people are anticipating that they are going to have one interest-rate hike in September, and then cool off yet again. This slow and gradual interest-rate increase should keep the interest-rate differential between the 2 currencies fairly steady, and as long as the European Union doesn’t melt down from anything involving Greece, the Euro should be thought of as undervalued at the moment.

With that, it makes perfect sense that we go higher as people are starting to look for value in other places. I believe that a lot of investors are simply looking for something beyond US Treasuries now, and that of course will have a significant effect on the currency markets. While I don’t think this is necessarily a market that’s going to “melt up”, I think we are witnessing a trend change over the longer term.