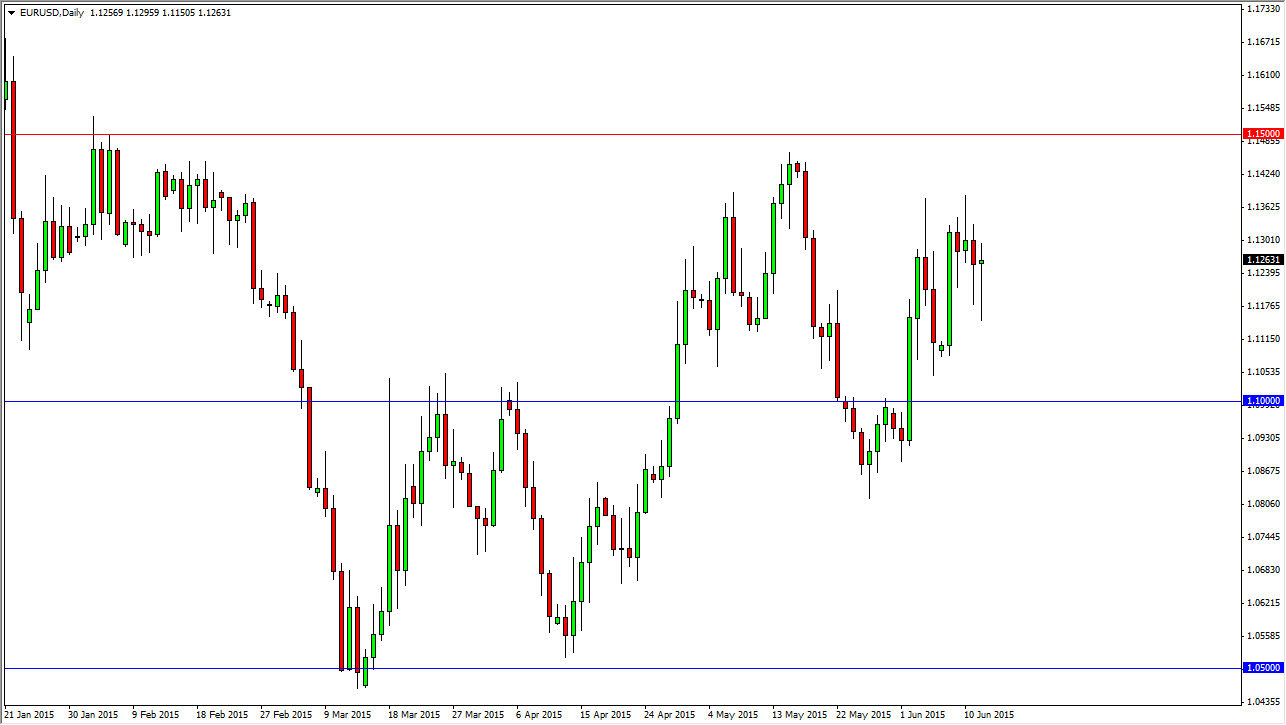

The EUR/USD pair initially fell during the session on Friday, but yet again ended up forming a hammer. Three out of the last four sessions have formed this particular candlestick, which of course is very bullish. The only one that wasn’t a hammer was a shooting star, which shows bearishness. In other words, it seems as if the market is going to remain volatile for a moment here, and that we will continue to go back and forth in short-term moves. With that being the case, I believe that you can simply take the simplest decision that can be made out of this, and assume that the 3 to 1 ratio suggests that the buyers are most certainly more convinced than the sellers.

With this, I believe that it’s only a matter of time before we break down but I also believe that it will take several attempts. Short-term pullback should be buying opportunities but be aware of the fact that it will probably only be for about 30 pips at a time. With that being said, I am paying attention to time frames that I don’t typically deal with.

Short-term charts

I am looking at the 30 minute charts in order to trade the EUR/USD pair, and I’m also keeping the position size low as I am not necessarily as comfortable trading short-term charts as I am daily charts. Ultimately though, the market should break above the 1.14 level and make a serious attempt towards the 1.15 level. If we can get above there, the market will then change trends in my opinion and what should continue to go much higher. I think at that point in time, it becomes a “buy-and-hold” situation as well as “buy on the dips” scenario.

As far selling is concerned, it’s not until we get well below the 1.10 level, and quite frankly probably below the 1.09 level that I would consider doing so. With that, I simply take what the market offers right now: small gains to the upside.