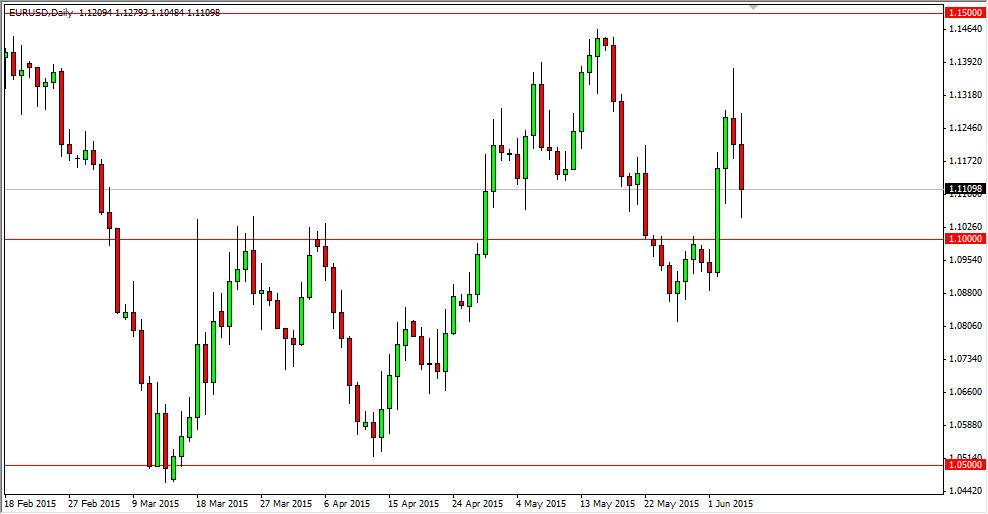

The EUR/USD pair fell during the Friday session in reaction to a better than anticipated jobs number coming out of the United States. This of course has people thinking that perhaps the Federal Reserve will have to raise interest rates sooner rather than later. However, I think that has already been the case and therefore not much has changed. Truthfully, most people that I know think that the Federal Reserve will raise interest rates in September, and see what happens next.

I believe that the 1.10 level below will continue to be rather supportive, so I’m not interested in selling this pair. In fact, I would need to see this market breakdown below the 1.09 level in order to feel even remotely comfortable doing so. I think that we are about to see a bit of a bounce, probably somewhere near the 1.11 handle.

Trend change?

I’m not real sure yet, but I think we are in the process of seeing the trend change. I will be much more comfortable saying that once we are above the 1.15 level, which for me is a major break out. In the meantime, we could see a bit of a summer range, with roughly 1000 pips being the battlefield if you will.

I believe the 1.10 level is going to attract a lot of attention because it’s essentially “fair value” as far as the market is concerned. I believe that the 1.05 level is the absolute bottom, and therefore it makes sense that we would rise towards that level if we can break down significantly. However, I’m not ready to say that’s going to happen quite yet. I believe personally that the fact that we made a “higher low” recently suggests that the trend and the momentum is most certainly heading towards the upside again.

On top of all of that, you have to begin to question whether or not there’s anybody left to sell the Euro anyway? It has been sold off so brutally that it’s difficult to imagine that somebody wants to place a long-term bet that it will fall even further.