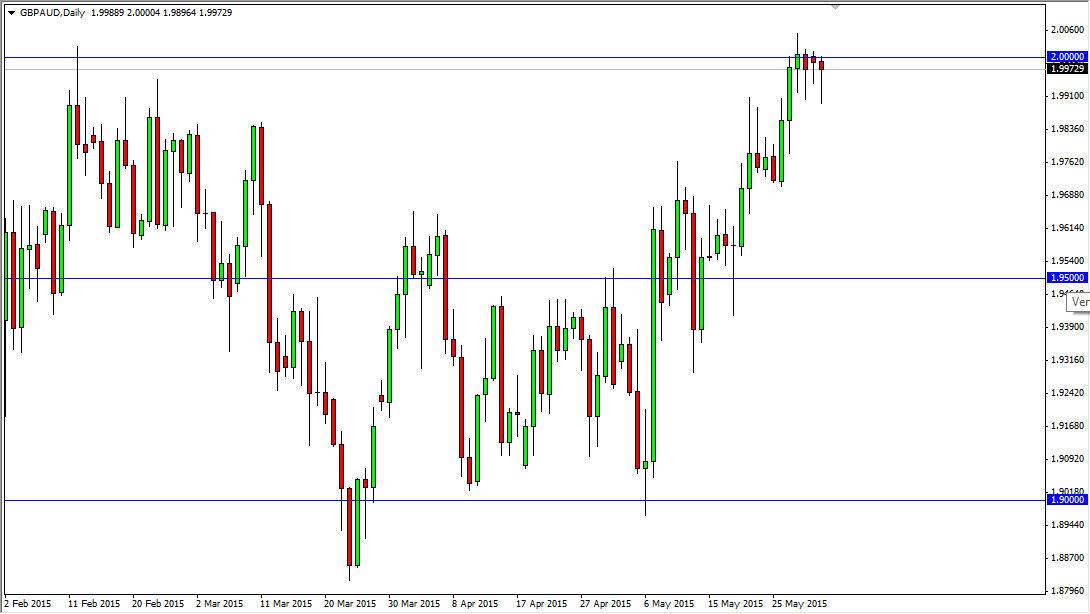

The GBP/AUD pair fell initially during the session on Monday, testing the 1.99 handle yet again. We have seen this several sessions in a row now, as we press up against the 2.00 level. This of course is a very bullish sign, and if we can break above the recent high at the 2.0060 level, I feel that this market will continue to go much higher. After all, breaking above the 2.00 level is psychologically significant, and with that it is a bullish market just waiting to happen.

However, you can’t force the issue. You have to wait for the breakout in order to feel comfortable, although we could just simply go sideways for a while and that wouldn't necessarily be the end of the world, you don’t want money sitting around when it could be making you more money somewhere else.

Buying breakouts

I will not hesitate to buy me a breakout, simply because the risk to reward ratio is so large. After all, the worst thing that could happen is that perhaps we pullback and you lose roughly 100 pips. On the other hand though, if we break out to the upside for a large move higher, the move could be something you hang onto for weeks, if not months. Keep in mind, breaking above a psychological round number such as 2.00 doesn’t happen every day, and that does typically signal that we are going to go much farther in that direction.

On top of that, the Australian dollar is inherently riskier to own them the British pound, and the British pound itself is “less bad” than the Australian dollar. Remember, when you trade 2 currencies, you are trading relative strength, so even though they both are a bit soft, there is going to be one that is softer than the other. In this particular case, I feel that the Australian dollar is that particular currency. I believe that once we break above the recent high, this will not only be a “buy-and-hold” market, but also a “buy on the dips” type of market.