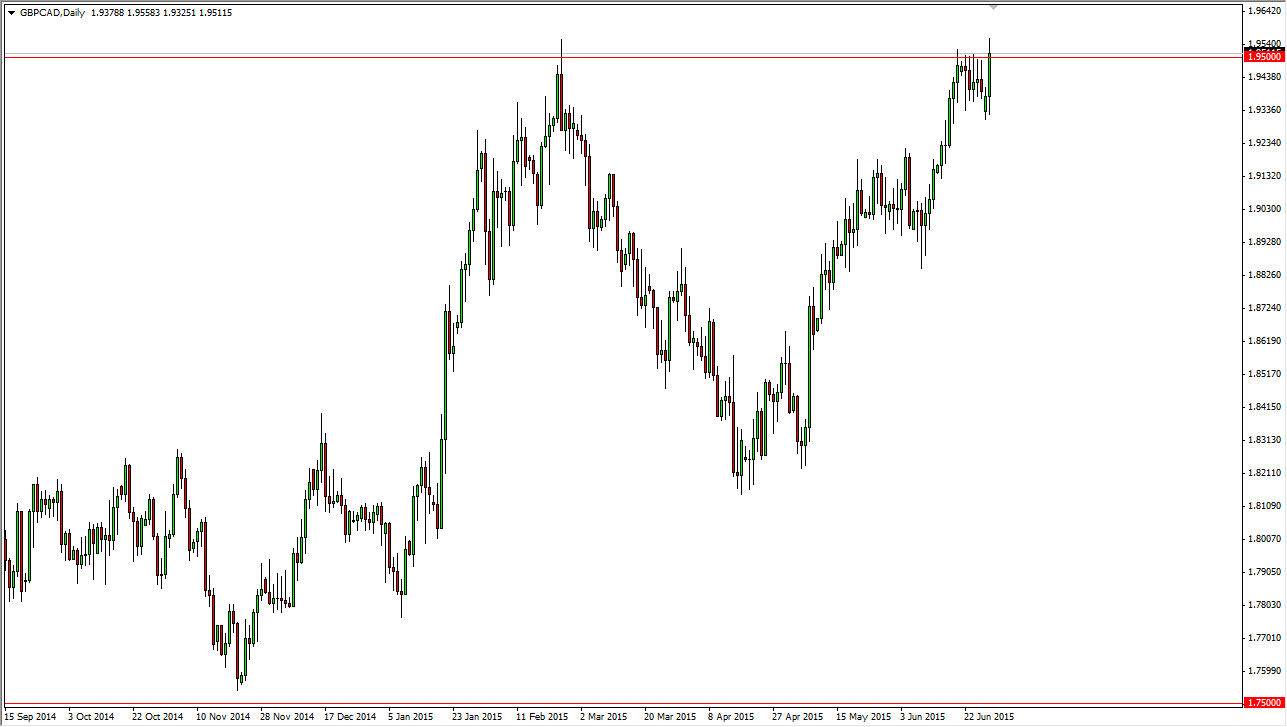

The GBP/CAD pair continues to show strength, as Monday saw the pair test the 1.95 level yet again. We did break above there, and have essentially made what could be a double top, but it’s a bit early to start thinking about selling this pair. Quite frankly, if we can break above the top of the range for the session, we should see the market go much higher and perhaps head to the 2.0 level given enough time.

This makes sense, because quite frankly the oil markets are essentially dead. We have seen British pound strength for some time now, so the idea of the British pound climbing against the Canadian dollar isn't exactly a real stretch of imagination. I believe that we will break out to the upside but also recognize that confirmation will be needed. Because of this, I am actually not going to buy this pair until we break the top of the range for the session on Monday, and on a daily close.

Volatility ahead

One thing you can count on in the currency markets now will be volatility. Because of this, you will have to be able to hang onto the trade longer-term in my estimation. I don’t exactly expect a “melt up”, as this market will more than likely find quite a bit of noise. I also believe that pullbacks will continue to offer value in the British pound as the oil markets simply seem unlikely to be able to sustain any real strength in the Canadian dollar.

Even if we break down from here, I see a significant amount of support near the 1.9350 level, which is something this market can quite easily reach in one day. In other words, to simply be patient and follow what has been a very nice trend higher but might be slightly overextended. This point in time, I don’t really have any real interest in selling this pair as there’s far too much in the way of support below.