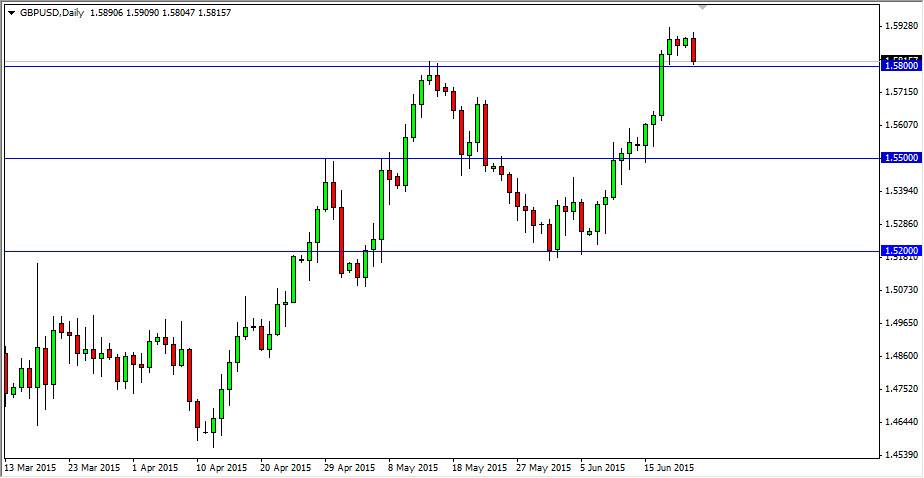

The GBP/USD pair fell during the course of the session on Monday, testing the 1.58 level for support. The market should continue to see buyers in this general vicinity, and as a result I believe that the market will attract buyers. After all, this is a market that has been in an uptrend for some time now, and the area of course was resistance, which should now be support.

As far as I’m concerned, this market cannot be shorted until we get well below the 1.57 level, and as a result I am essentially “buy only” at the moment. I think that the market will then head towards the 1.60 level as soon as we start bouncing, although it won’t necessarily be the easiest move to make as there is plenty of noise between here and there so it will take a certain amount of tenacity and vision to hang onto the trade.

Buying dips

I am buying dips on short-term charts above here as well. I believe that you can add to your position in small increments in order to build up a larger position. Regardless, I don’t have any interest in selling this pair until we get well below the 1.55 level, which I think is essentially the “floor” in this market as the area does represent a large amount of support at the moment. I believe that as long as we can stay above there, you have to think that the market will eventually find buyers. The British pound certainly look strong at the moment.

In fact, I believe that the British pound will continue to strengthen against many other currencies around the world, not just the US dollar. However you have to keep in mind that this is the essential “measuring stick” as far as strength is concerned and as long as this pair goes higher, you have to think that buying the British pound is the only you can do with the particular currency.