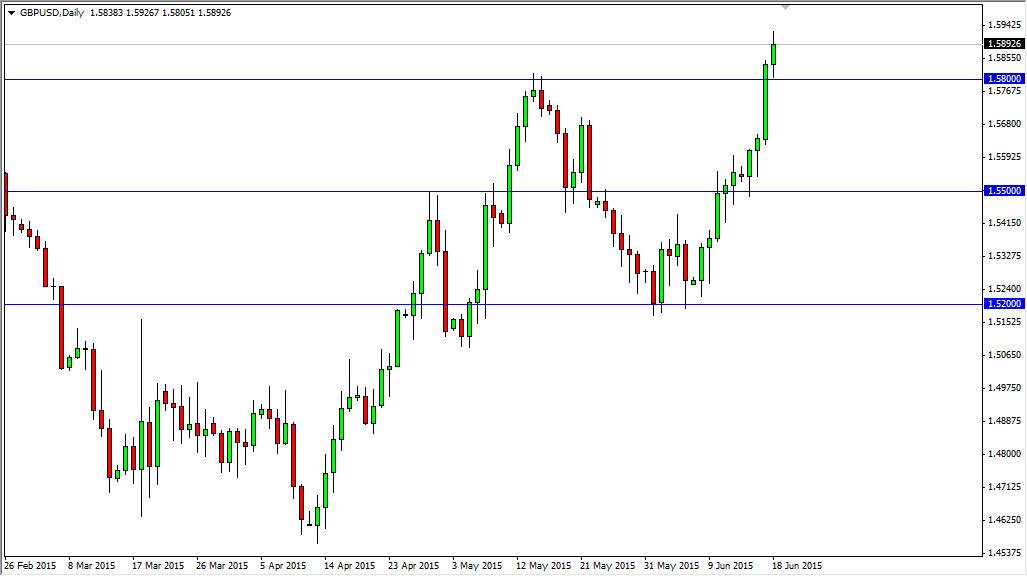

The GBP/USD pair has broken out above the 1.58 level, and Thursday sent this pair even higher as buyers continue to go long. That being the case the market looks as if it is ready to continue going much higher but we will probably see quite a bit of volatility only at the 1.60. That being the case, I feel that every time this market dips, buyers will step back into the market and push the British pound higher. The US dollar itself looks a little bit soft in general as the US Dollar Index looks like it’s ready to roll over. With that, I would fully anticipate seeing this market go higher.

I am perfectly comfortable buying this pair on short-term pullbacks as long as we stay above the 1.58 handle. Quite frankly, I would anticipate the support that runs all the way down to the 1.57 handle, so at this point time I am essentially “buy only” as the British pound look strong all-around Forex markets.

Look for value

Simply looking for value going forward, and I think that’s what a pullback is essentially value in a currency that is a without a doubt very strong overall. After all, the British pound has broken out against not only the US dollar, but the Australian dollar, and the Canadian dollar. I believe that it’s only a matter time before the British pound becomes the currency of choice by Forex traders around the world. I believe that pullbacks continue to offer value in all of these pairs, and the US dollar has to be thought of as the “measuring stick” when it comes to strength.

It is not until we break down below the 1.55 level that I would even remotely consider selling this particular market, and that does not look very likely anytime soon. With that, I believe that this becomes more or less a “buy-and-hold” type of situation soon, and that I will make quite a bit of money by simply adding small increments to my position time and time again.