GBP/USD Signals Update

Yesterday’s signals were not triggered as although the price did reach 1.5700 during the London session, there was no bearish price action there.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades may be entered between 8am and 5pm London time only.

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.5753.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the price reaches 1.5800 and leave the remainder of the position to ride.

Long Trade 2

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.5700.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the price reaches 1.5750 and leave the remainder of the position to ride.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.5940.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the price reaches 1.5875 and leave the remainder of the position to ride.

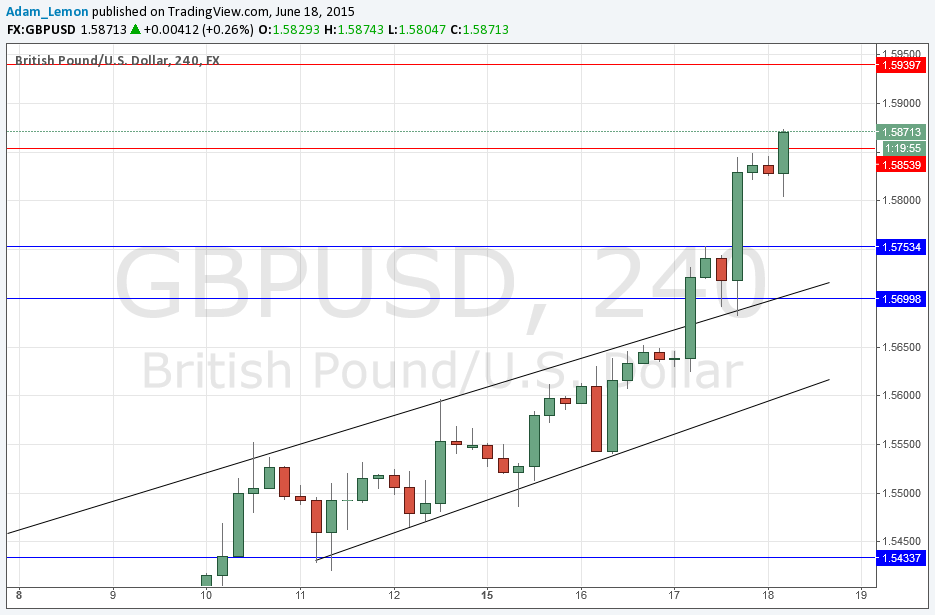

GBP/USD Analysis

I forecast yesterday that the resistance at 1.5700 and the bullish channel in general would hold until the FOMC news releases after the London close. I was wrong about that as we got a bullish breakout following positive GDP news during the London session.

The FOMC outcome is not seen as positive generally for USD bulls, and as the GBP is really the relatively strongest currency around right now, the pair gained strongly following the release, and is making new highs during early London session trading.

Sentiment in this pair is strongly bullish so longs are probably going to be better than shorts. There is no obvious resistance until 1.5940 although the round number at 1.5900 might halt upwards movement if we get there.

There are high-impact events scheduled today for both the USD and the GBP. Regarding the USD, there will be CPI and Unemployment Claims data at 1:30pm London time followed by the Philly Fed Manufacturing Index later at 3pm. Concerning the GBP, there will be U.K. Retail Sales data released at 9:30am.