GBP/USD Signals Update

Yesterday’s signals were not triggered, as there was no sufficiently bullish price action at 1.5850.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be made before 5pm London time only.

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.5753.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 1.5925 and leave the remainder of the position to ride.

Long Trade 2

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.5700.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 1.5925 and leave the remainder of the position to ride.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.5850.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the price reaches 1.5875 and leave the remainder of the position to ride.

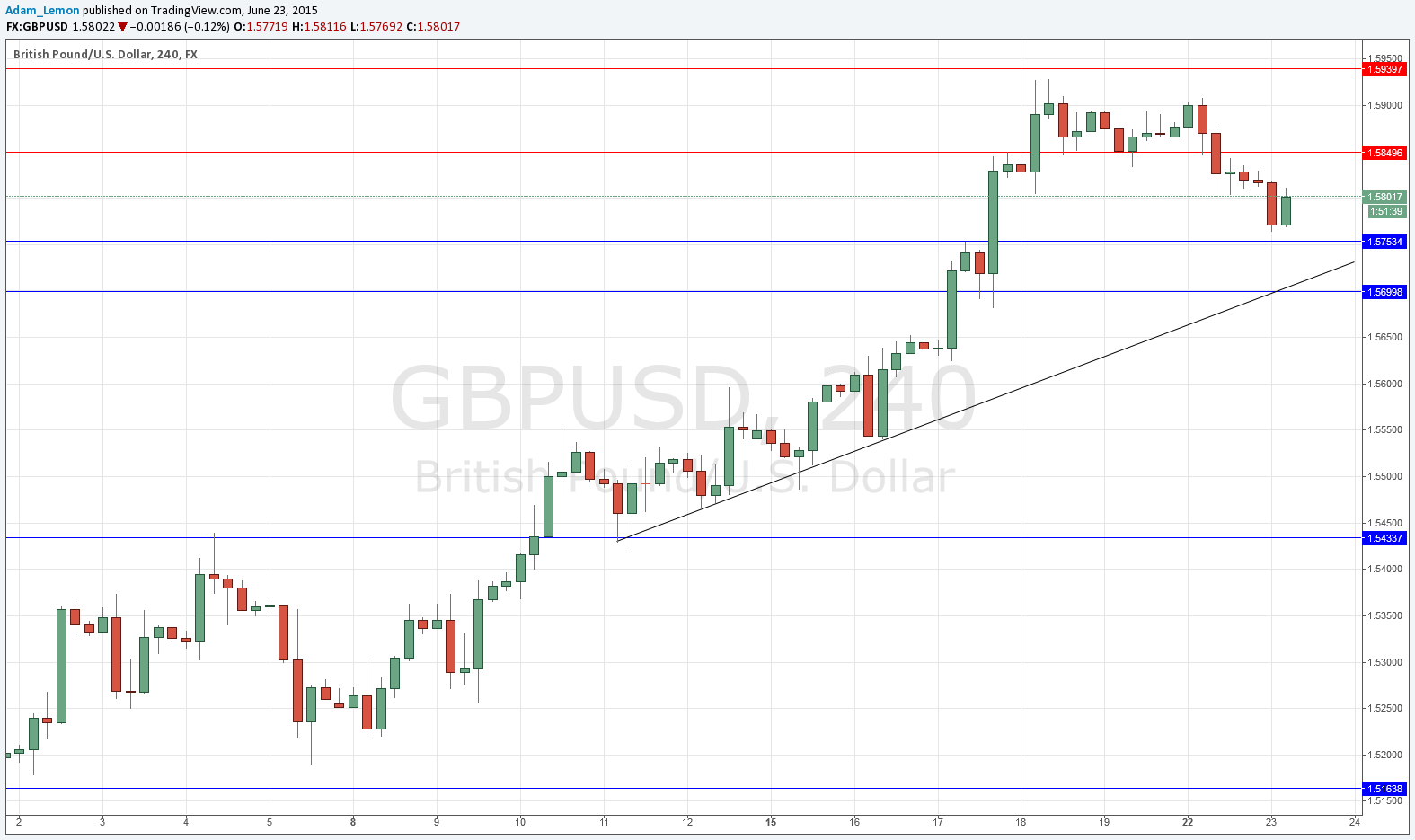

GBP/USD Analysis

The pair fell yesterday, even before the USD started strengthening across the board later during the New York session. The focus seems to have shifted away from the GBP which last week was strongly bullish. However overall it is true that the upwards trend has not been so severely dented. The real test of this will be whether we can break up past 1.5850 soon, which may have flipped from support to resistance.

There should be good support below confluent with the psychologically key level of 1.5750.

There are no high-impact events scheduled today for the GBP. Regarding the USD, FOMC Member Powell will be speaking at 3pm London time, followed half an hour later by Core Durable Goods Orders data.