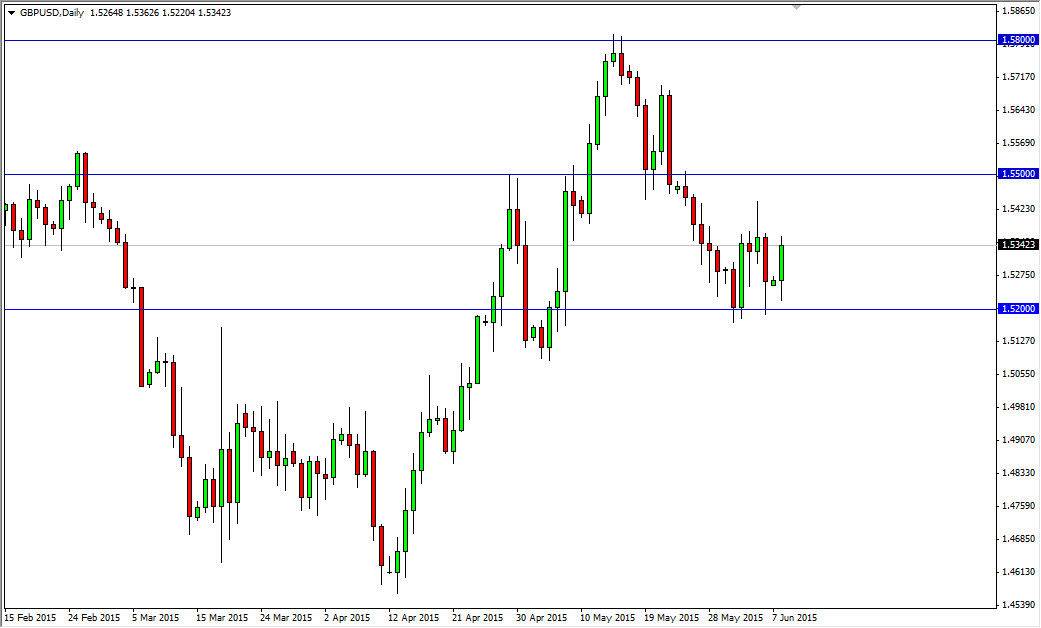

The GBP/USD pair initially fell during the day on Monday, but as it approached the 1.52 level, we bounce significantly to head towards the 1.5350 level. With that being the case, the market looks like it is ready to continue to go higher as we closed out the day towards the top of the range. Ultimately, I think that this market should go to the 1.54 level, which is where the shooting star formed from a couple of days ago. Ultimately, if we can get to the 1.55 level, we could then break out and head to the 1.58 level. Nonetheless, I believe that the British pound will continue to strengthen in general, and perhaps finally break out to a longer-term buy-and-hold type of situation. With this, I also recognize that there is a massive amount of support below, and even if we break down below the 1.52 level, it’s very likely that the support extends all the way to the 1.51 handle next.

Buying dips

I believe that buying dips going forward will be the way to go in this particular pair, but you may have to look towards short-term charts in order to get those entries. I don’t have any scenario in which I sell this pair until we get well below the 1.50 level, which doesn’t look very likely to happen at the moment. Because of this, I am simply trading this in one direction, but I’m not going to just jump into this market randomly. I think you have to look for short-term pullbacks and show signs of support in order to get involved.

Ultimately, I think that this pair is trying to get back to the more common trend of simply going higher and higher given enough time. However, there are a lot of concerns coming out of Europe at the moment that of course can have a bit of a “knock on” effect in the United Kingdom. With this, I think it’s going to be choppy but I still think the buyers are going to take over.