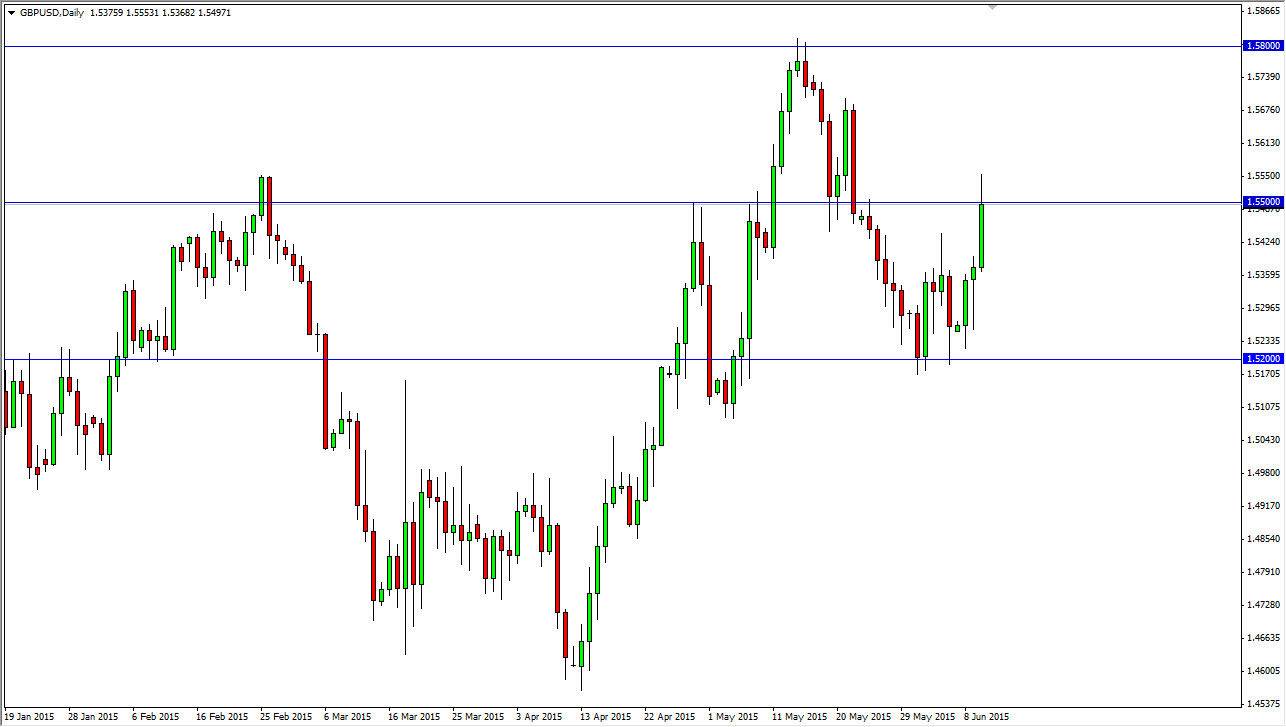

The GBP/USD pair broke higher during the course of the session on Wednesday, slicing through the 1.55 handle at one point during the day. However, you can see that we did break back down to that level by the end of the day, meaning that the breakout wasn’t necessarily 100% complete. However, I think the candle does tell us that the market is going to continue to go higher given enough time. It certainly seems to have the proclivity to continue the march north, and as a result I have no interest in selling. I look at pullbacks as potential buying opportunities on short-term supportive candles.

I also believe that a break above the top of the range for the Wednesday session would be reason enough to start buying yet again. I believe that once we clear the 1.55 level cleanly, we should then head to the 1.57 level and then probably to the 1.58 level. Above there, the trend continues to the upside for quite some time, and I would aim for at least 1.60 at that point in time.

Buying dips

I have absolutely no interest in selling this pair, at least as long as we are above the 1.52 handle. Even if we did break down below there, I think there’s enough support at both the 1.51 handle and the 1.50 handle to keep me from selling in general. I think that dips that appear in this market going forward are simply buying opportunities as a represent “value” in the British pound itself.

What I do look at this chart for more than anything else is a sign that the British pound is strengthening overall, and if I don’t take a trade here, I could very easily see buying the British pound against other currencies such as the Australian dollar. Don’t forget that currencies are most often measured against the US dollar for real strength, and that can translate into trades in the cross currency pairs. Ultimately, I think the British pound continues to strengthen.