Gold prices continued to grind lower Thursday as the economic data from the Unite States provided further evidence that the economy is set to rebound in the second quarter after a chill at the start of the year. The latest figures from the Commerce Department showed that consumer spending increased 0.9% in May. Although the dollar continues to benefit from the optimism over U.S. economic growth, market players seem to be hesitant to add large short positions ahead of the weekend.

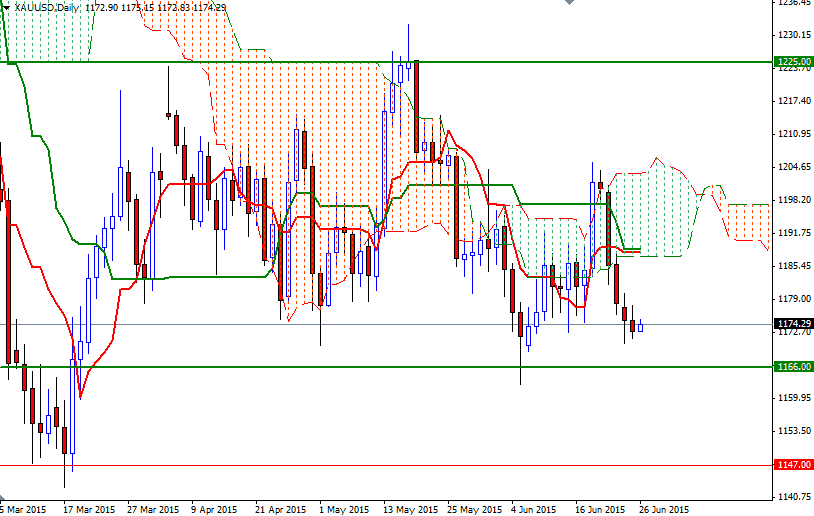

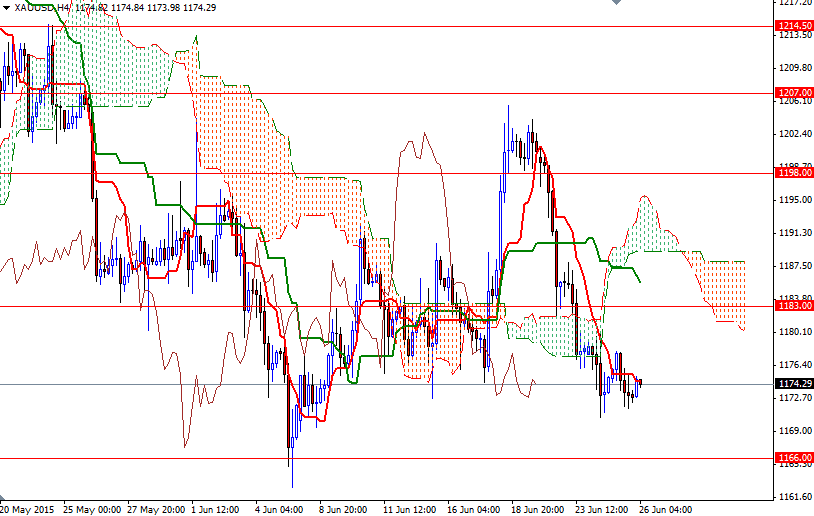

The XAU/USD pair dipped to a session low of $1171.54 yesterday but steadied around those levels after a meeting of Eurozone finance ministers ended without a resolution for Greece. Concerns about Greece's economic crisis haven't spark a great deal of safe haven demand for the yellow metal so far but failure to end the stalemate before it is too late could provide a temporary boost. The technical picture remains weak, with the market trading below the Ichimoku clouds on the weekly, daily and 4-hour time frames, plus we have negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines.

However, the potential downside is likely to be limited until the 1168/6 support is convincingly broken. If the XAU/USD pair manages to hold above this region, we might see a push up to the bottom of the daily cloud (1192/88). But of course, in order to reach there, the bulls have clear nearby resistances such as 1179 and 1183. The area around the 1166 level has been supportive recently so capturing this strategic point is essential if the bears want to charge towards the 1147 level. On its way down, expect to see some support at 1157.