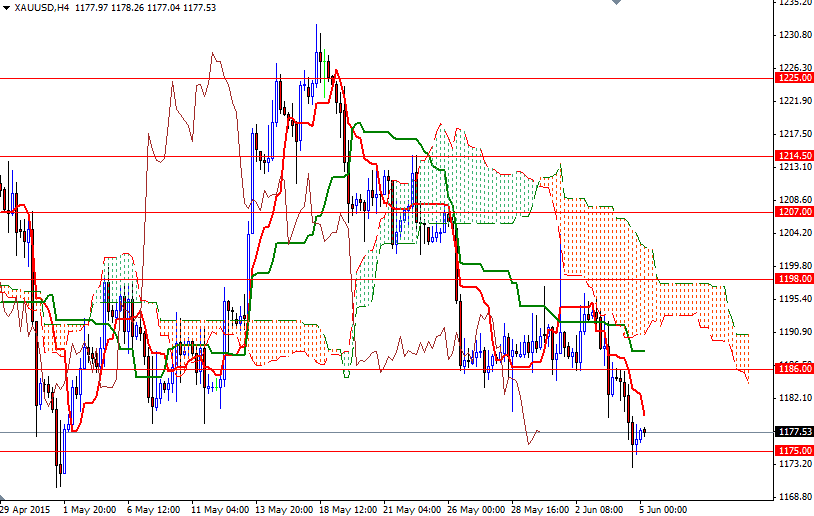

Gold prices settled lower on Thursday, extending losses from the previous session, as upbeat data on the U.S. economy eroded demand for safe-haven assets. The XAU/USD pair initially made a move to penetrate the 1186 level but found certain amount of resistance and changed its course. The metal deepened its losses after a Labor Department report showed that the number of people filing new claims for unemployment benefits last week fell by 8K to 276K.

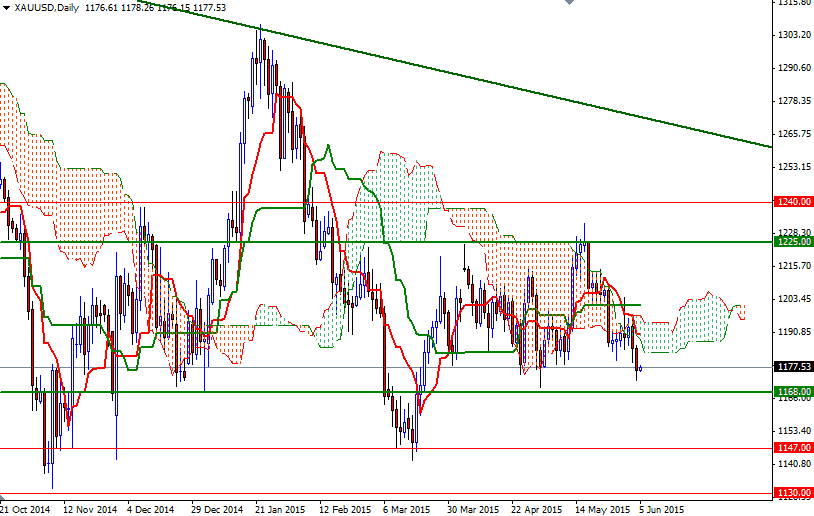

The market seems to be steady, just above the 1175 support level, during today's Asian session as people are waiting for the U.S. non-farm payrolls report for more clues about the economy. The data will give markets fuel to speculate on the timing of an interest rate hike by the Fed. Lately, I have been repeating that the path of least resistance for XAU/USD is lower but as you can see on the daily chart we are sitting on a vital support which hindered the bears' advance a number of times in the past so I would advise caution at this point.

If the downward pressure continues and prices can't hold above the 1175 level, it is likely that we will see the pair testing the next support in the 1668/6 region. Dropping through the 1166 level would open up the risk of a move towards 1157 and a retest of this year’s low at 1143. The first hurdle gold needs to jump is located around the 1186 - 1184.80 levels. If the support below remains intact and prices climb above 1186, the bulls may find a chance to test nearby resistances at 1192 and 1198.