Gold prices settled lower yesterday, extending their losses to a fourth straight session, as strength in the U.S. dollar and expectations of higher U.S. interest rates continued to weigh on the market. The XAU/USD pair traded as low as $1168.10 an ounce, the lowest level since June 9, after a report revealed that the world's biggest economy contracted less than estimated in the first quarter. According to the Commerce Department, gross domestic product fell at a 0.2% annualized rate, revised from a 0.7% drop.

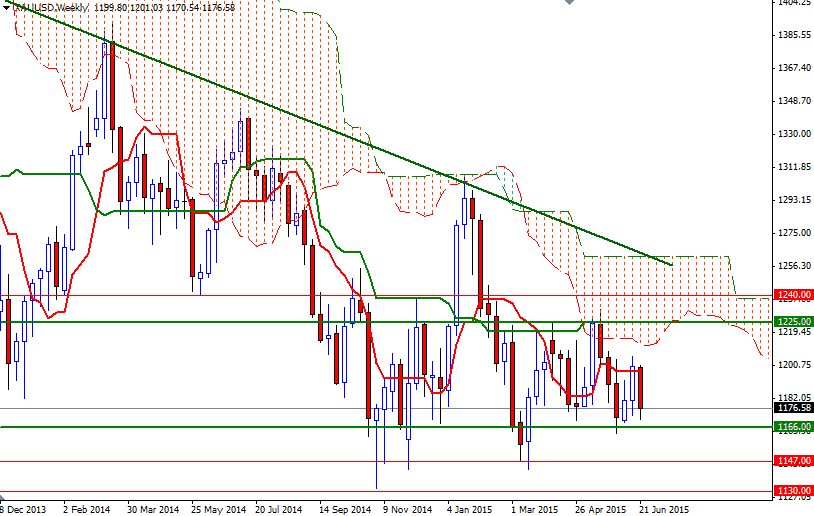

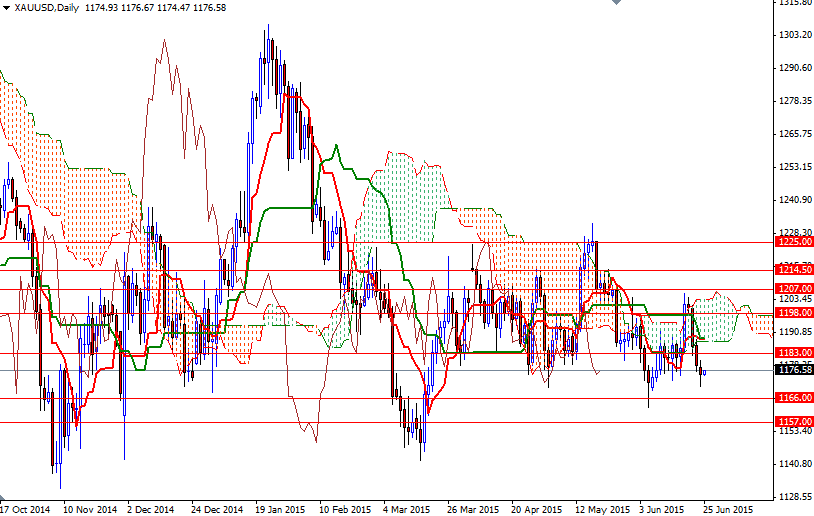

Although the outlook for the greenback remained upbeat, the area between the 1166 and 1168 levels -which the market tested yesterday- has been holding the market up for the last few months. Because of that, it wouldn't be surprising to see prices rebounding towards the 1183 level. If the market passes through 1183, the pair will most likely proceed to the next barrier located in the 1192/88 region. Since the bottom of the daily Ichimoku cloud, Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) lines cluster in that area, expect some significant resistance. This resistance has to be breached in order to consider an expansion targeting 1202 - 1198.

To the downside, initial support is around 1168/6, followed by the June 6 low of 1162.66. The XAU/USD is pair trading below the clouds on both the daily and 4-hour time frames, plus the Tenkan-Sen and Kijun-Sen lines are negatively aligned. If the bears continue to dominate and capture this fort, I think they will have a chance to tackle the 1157 level. Once below that, there is a strong possibility that prices will drop to 1147 before finding some support.