Gold prices ended Wednesday's session up 0.76%, marking the third consecutive rise, as weakness in the greenback helped prices regain their footing. The precious metal was also supported by safe-haven bids from uncertainty over the Greek debt crisis. The XAU/USD pair traded as high as $1192.21 an ounce before pulling back to $1186 level.

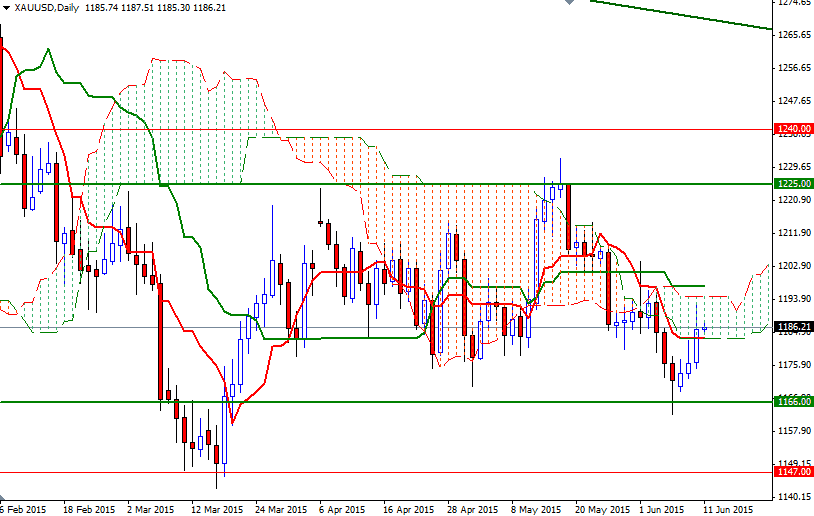

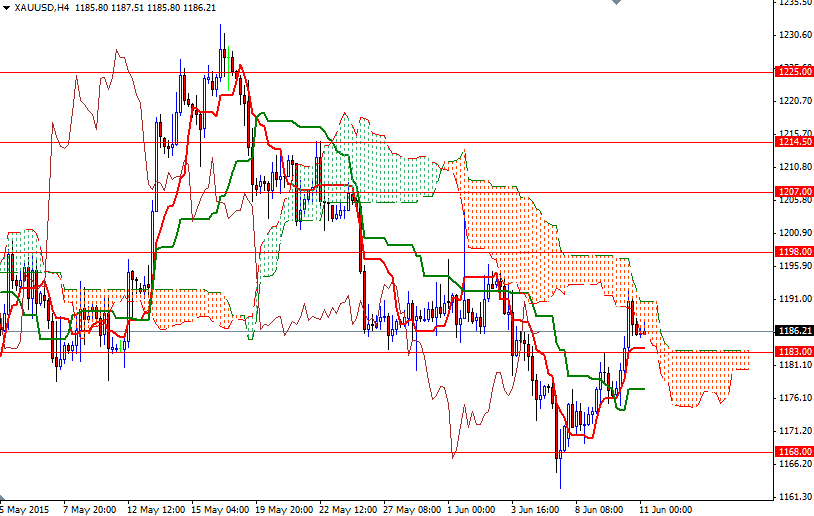

From a purely technical point of view, it is no surprise the market encountered resistance in the area between 1186 and 1195. This region is currently occupied by the Ichimoku clouds on both the daily and 4-hour time frames. Technically speaking, the Ichimoku cloud indicates an area of resistance (or support depending on its location) and when they overlap, they can create a tough ceiling to penetrate.

With that in mind, I think the bulls will have to push the market beyond the 1195 level so that they can make a fresh assault on the 1202/0 zone. Shattering this barrier would make me think that the bulls will be targeting 1207 afterwards. On the other hand, if the bears manage to dodge incoming attacks and prices start to drop, we may revisit the supports at 1183 and 1177/5. A successful break below 1175 may trigger some extra pressure that can take us back to the 1168/6 area. Today's retail sales numbers might provide the catalyst that both sides need.