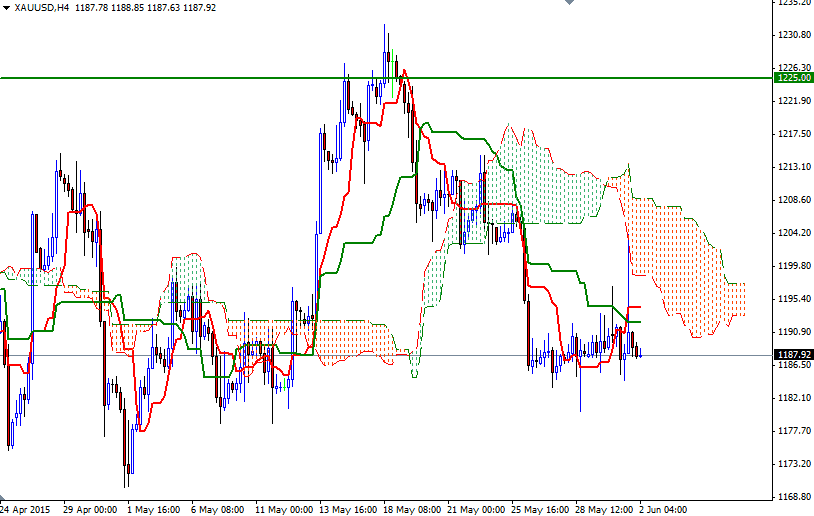

Gold settled down $1.69 at $1188.99 per ounce on Monday as strength in the dollar weighed on the market and dimmed the metal's appeal. The XAU/USD pair initially advanced to a session high of $1204.15 (the bottom of the Ichimoku cloud, 4-hour chart) on comments by Boston Fed President Eric Rosengren but the dollar made a comeback and pushed prices down, back below the $1191 level, after data on manufacturing activity and construction spending beat estimates. Data released from the Institute for Supply Management showed that the index of national manufacturing activity rose to 52.8 in May from 51.5 the prior month.

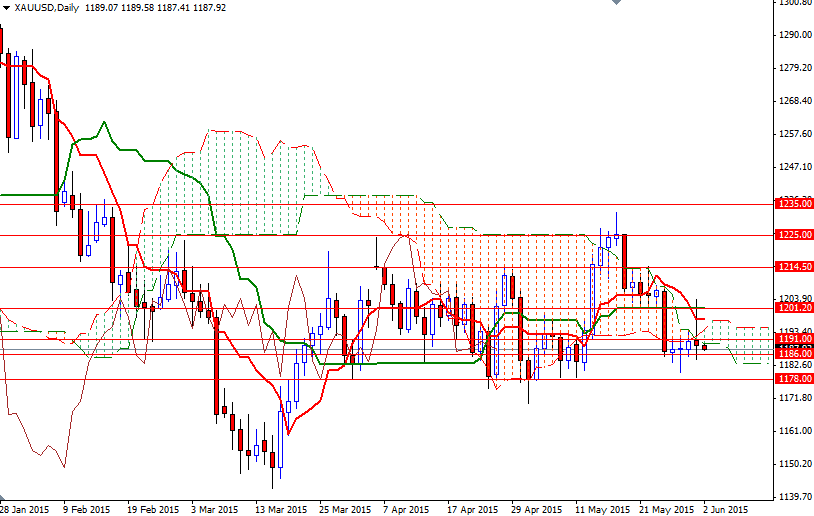

Although weak economic growth in the first quarter complicates matters for Fed policy makers, recent improvements in the economy keep expectations alive for an interest rate hike this year. That being the case, the market looks as if it will continue to consolidate between the 1225 and 1168 levels in the near term. Currently, both the Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-day moving average, green line) lines on the long term (weekly and daily) charts are flat, indicating lack of real momentum. But, as I mentioned in my previous analysis, trading below the weekly and daily Ichimoku clouds makes it difficult to get bullish on gold.

The market is stuck in a tight trading range during today's Asian session so I will keep an eye on the 1194.25/1191 and 1186/1183 zones. If the XAU/USD pair climbs and holds above 1194.25, we might see the market testing the resistance levels at 1197.54 and 1205/1201.20. Only a close above the 1205 level could give the bulls the extra momentum they need to retest the 1214.50 level. On the other hand, if the 1186/1183 support level is broken, it would be technically possible to see the market heading back to 1178/1175 region. Breaching this area might encourage sellers and increase the possibility of an attempt to visit the 1168/1166 support.