Gold prices fell for the third time in four sessions but remained well within the consolidation that we’ve seen for some time. The metal gave up most of their gains from a day earlier as a stronger dollar offset gains from safe-haven bids prompted by a break down in talks between Athens and its European partners. The XAU/USD pair traded as low as $1176 an ounce after the Commerce Department reported that building permits climbed 11.8% to a 1.28 million pace.

Attention will now turn to the Fed's policy statement and Janet Yellen's press conference. The markets are waiting for stronger clues on when the U.S. central bank would begin rising rates. The belief that the Fed will abandon its zero-rate policy some time this year has limited the upside potential for gold prices.

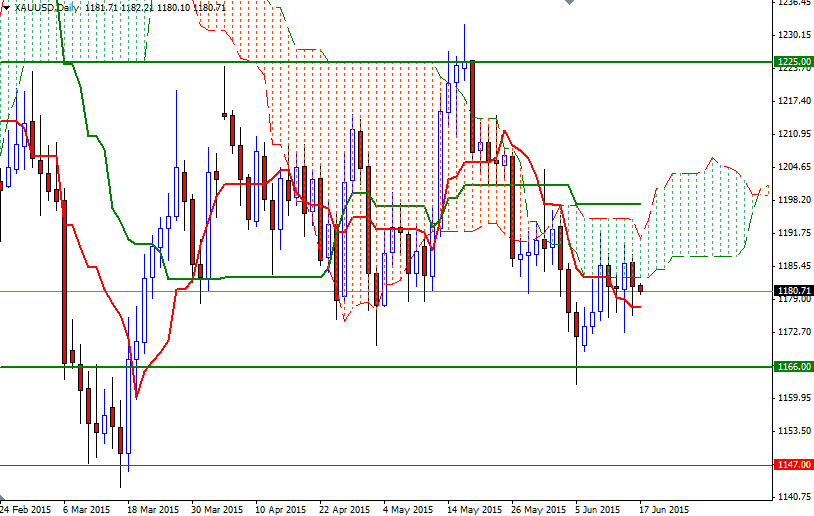

The market has been stuck between roughly the 1192 and 1168 levels for the last couple of weeks. Prices continue to feel bearish pressure from the (weekly and daily) Ichimoku clouds and negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-day moving average, green line) lines but the bulls are trying to hold market above the 1168/6 area. As I pointed out in my previous analysis, until we leave this relatively tight range, it will be hard to hang onto a trade for a reasonable length of time. To the upside, there are hurdles on the way such as 1183.41 and 1191. If the market breaks through, it looks like XAU/USD will head towards 1202 - 1198. On the other hand, it is quite possible that the pair will continue its bearish tendencies if prices drop below the 1175/4 area. In that case, it is likely that the market will be testing the 1168/6 area afterwards. Breaking below this support would open up the risk of a move towards 1157.