Gold prices advanced to their highest levels since May 26 as the greenback continued to slide the day after the Federal Reserve cut economic growth forecasts and hinted that the pace of rate hikes will be slower. Concerns that Greece might be edging closer to a debt default also boosted prices. The government in Athens has less than two weeks remaining to reach a deal with its international creditors or face defaulting on an existing loan repayment due to the IMF.

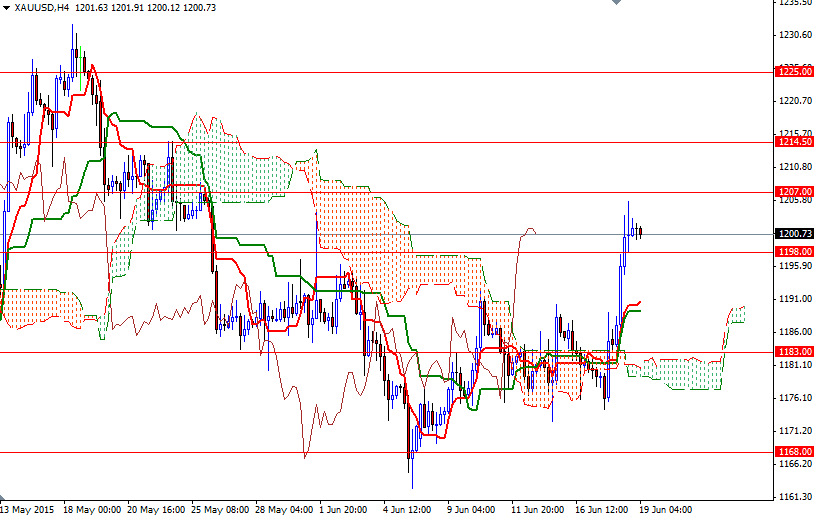

The XAU/USD pair is currently wondering around the 1200 level as the market tries to digest yesterday's upswing. From a technical point of view, breaking out of the 1192 - 1168 area, where the market spent its last weeks, implies that the short-term technical outlook has shifted to the upside. We have a strong bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen line (twenty six-day moving average, green line) cross on the 4-hour time frame and the Chikou-span (closing price plotted 26 periods behind, brown line) is indicative of solid upward momentum.

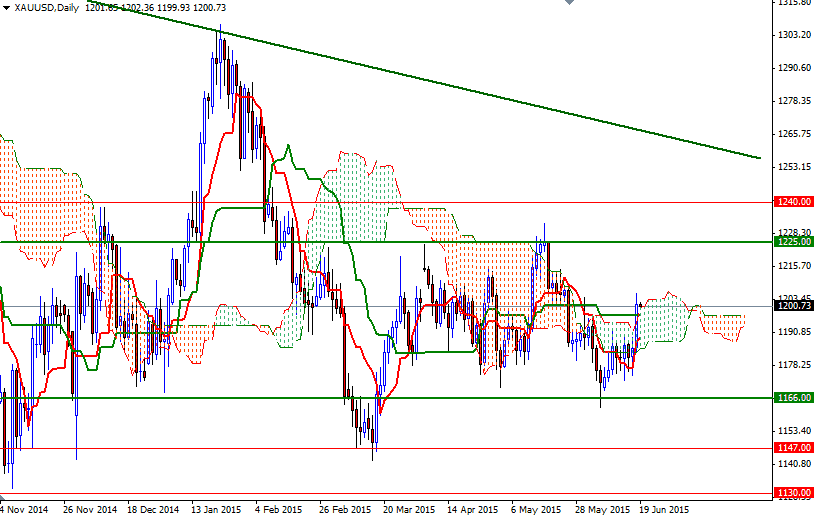

If the bulls can maintain the control, the XAU/USD pair is most likely headed for the 1240/25 region. Of course, there are some strong resistance levels ahead such as 1207 and 1214.50 for the buyers to break through. However, keep in mind that the market often returns to a level it has struggled to break out of before approaching its new destination. Therefore, it is technically possible to see a pullback targeting 1198-1197.45 or even 1192. The bears will have to push prices back below the daily cloud if they don't intend to throw the towel.