Gold prices slipped for a third straight session and settled at $1178.33 per ounce, losing $7.57, as strength in the dollar and equities markets eroded the appeal of the precious metal as an alternative investment. Stock markets around the world closed higher yesterday on expectations that Greece will reach a deal with its creditors and avert a looming default that may prompt the country’s exit from the euro area. Data from the U.S. were mixed with a higher than expected new home sales and a weaker than anticipated durable goods orders number. Separate reports from the Commerce Department showed sales of new homes rose 2.2% in May, while orders for durable goods declined 1.8%.

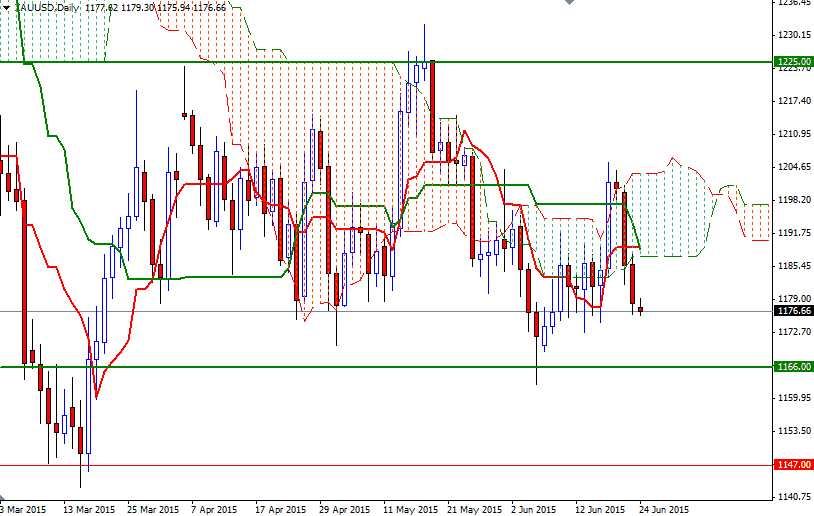

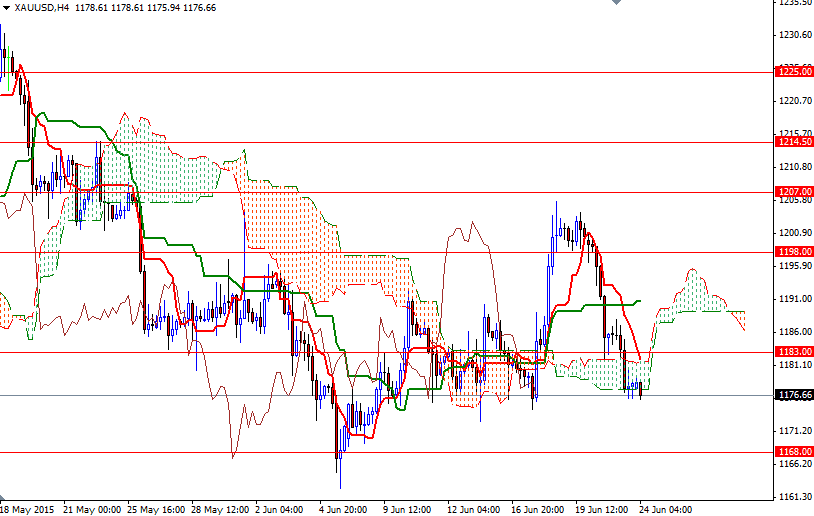

Apparently, the performance of the major equity markets will likely continue to influence the price of gold. Technical selling was also behind gold's 0.64% drop on Tuesday. Not surprisingly, breaking below the 1183/1 support dragged the XAU/USD pair to the 1177/5 area. This is the key level for bears to capture today if they intend to push prices lower and reach the 1168/6 region. Closing below 1166 would put us back on track with such a scenario eying subsequent targets at 1157 and 1147.

However, if the XAU/USD pair finds enough support above 1175 and turns north, expect a rebound towards 1183/2. Beyond that, sellers will be waiting in the 1192 - 1189.20 zone where the bottom of the daily Ichimoku cloud, Tenkan-sen (nine-period moving average, red line) and Kijun-sen line (twenty six- period moving average, green line) reside. The bulls will need to clear this barrier so that they can take the reins and tackle the 1202 - 1198 resistance which prevented prices from going higher last week.