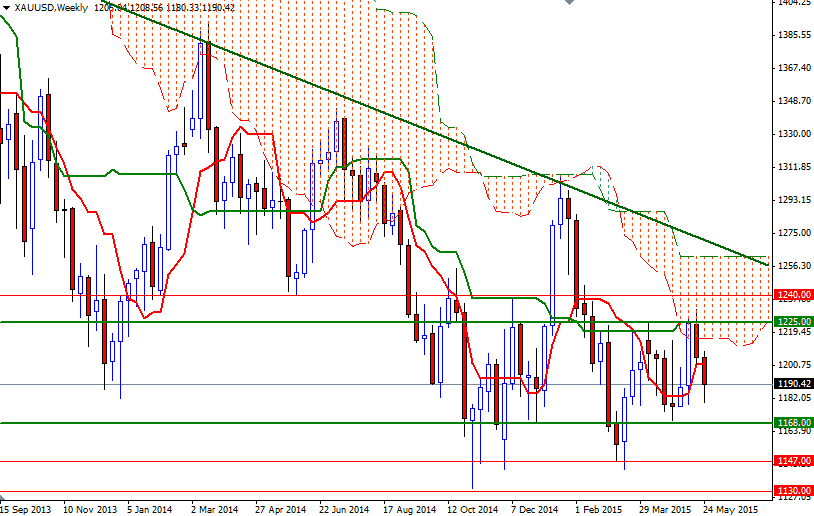

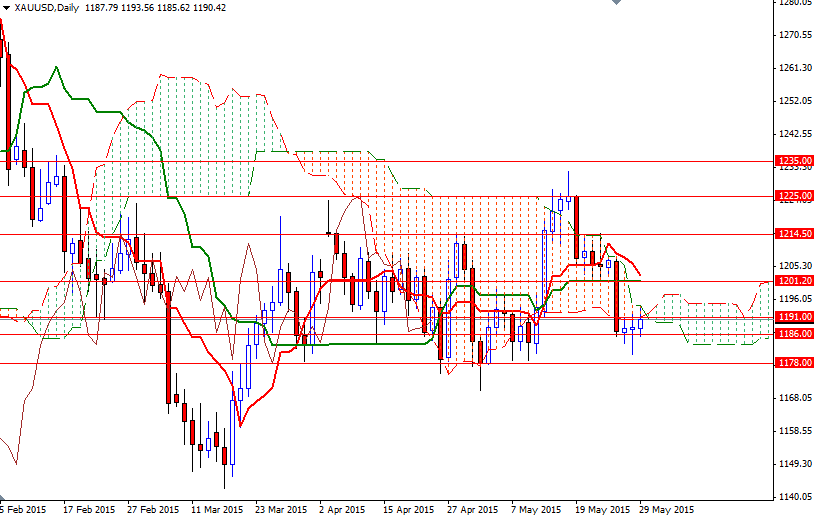

Gold prices fell for a second consecutive week but still ended the month with a modest gain of $6.37 an ounce. The market initially rallied all the way to the 1225 area but saw significant selling pressure as the bears came back into the marketplace, and eventually retreated towards the support at 1178. Over the course of the last couple of months the XAU/USD pair spent plenty of time in a relatively narrow range of around $60 as uncertainty persisted over Greek debt talks and the timing of U.S. interest-rate increases.

The precious metal's gains were mainly driven by a weak dollar after a series of economic data out of the world's largest economy disappointed the markets and fanned speculation of a delay in the Fed's timetable. But the Fed's outlook on the economy remains optimistic as policy makers think that the slowdown during the first quarter was the result of a variety of transitory factors. That means, whether it's September or December, the U.S. central bank remains intent to normalize policy.

With that, I think that the market is going to continue to consolidate between the 1240/25 area on the top and the 1168/6 level on the bottom for some more time. Sooner or later a breakout will occur but in the short-term I assume that the XAU/USD pair will stay within this area. Technically, the area above 1225 should continue to offer resistance as it is currently occupied by the weekly Ichimoku cloud. If we can get above 1225, the market will probably test the 1244/0 (Fibonacci 61.8) and 1257 (a former support/resistance) resistances though. On the other hand, if the market fails to make a sustained break above the 1205 - 1201.20 region, prices will eventually pull back to test the supports around 1178/5 and 1168/6. I think eliminating this floor will pave the way towards the 1147 support.