Gold settled slightly lower on Friday, but scored a gain of nearly 1% for the week as sagging risk appetite and intensifying worries over Greece's debt problems lured some investors back to the market. Greece needs a deal to unlock the final 7.2 billion euros of bailout loans but the International Monetary Fund's decision to halt talks with Greece worsened the situation. Without release of the payment, default will become inevitable. Gold usually sees safe-haven demand during times of financial uncertainty but the possibility of Greek default provided only moderate support so far.

The market has been fixated on the Federal Reserve, which seems very likely to begin to normalize policy sometime this year, therefore investors are hesitant to put larger bets ahead of Wednesday's FOMC announcement. Federal Reserve Chair Janet Yellen will hold a press conference following the meeting, at which Fed officials publish updated forecasts for growth, inflation, unemployment and interest rates.

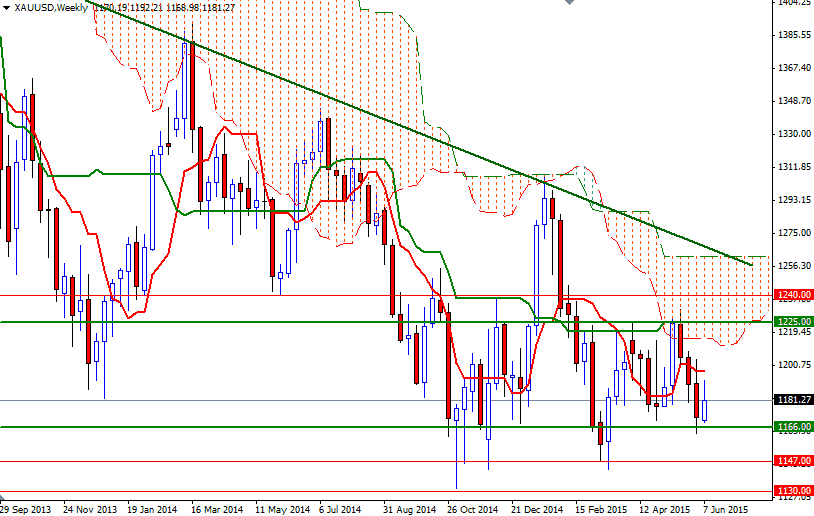

The 1168/6 area has been supportive in the past, and should continue to be so in the near term. Similarly, there is a significant amount of resistance in the 1202 - 1198 region. That being the case, the market looks as if it will tend to consolidate between the 1166 and 1202 levels. On the upside, the initial resistance levels stands at 1186 and 1190.33 but since the daily Ichimoku cloud sits just above prices, I pay more attention to the area it occupies than specific levels. That means, the bulls will have to push the market above 1202 so that they tackle the next barrier at the 1207 level. If the XAU/USD manages to pass through this resistance, then the 1207 level might be the next port of call. The bottom of the cloud on the 4-hour time frame currently sits around 1175/4, so that will be the first support to keep an eye on. A break below 1174 would indicate that the market is heading back to the 1168/6 zone. If prices close below 1166, there is a good chance we will see XAU/USD testing the support at 1157.