Gold prices ended Friday's session down $1.18, to settle at $1200.46 an ounce as traders took profits from a recent rally to a three-week high. Despite Friday's losses, gold prices advanced 1.16% ($19.38) for the week, boosted by worries over Greek debt crisis and the U.S. Federal Reserve's caution on an interest rate rise. The impasse in negotiations over Greece’s bailout program has increased the risk of a Grexit and kept equities under pressure. The country's departure from the euro zone doesn’t have the potential to cause a catastrophic crisis but it would have repercussions (at least in the short term) beyond Greece’s borders.

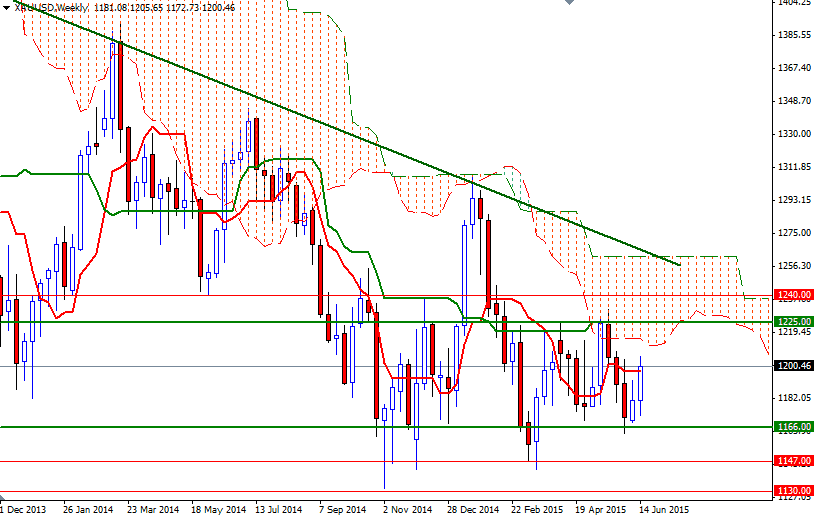

On the other side of the Atlantic Ocean, there is the Federal Reserve which is poised to raise interest rates this year (a move that should be bullish for the US dollar). Although the pace of rate hikes is likely to be slower than in the past, rates will start their upwards trend before the end of 2015 and that sets a generally negative backdrop for gold. With these in mind, I still expect the market to continue consolidating between the 1240/25 area on the top and the 1168/6 level on the bottom for some more time.

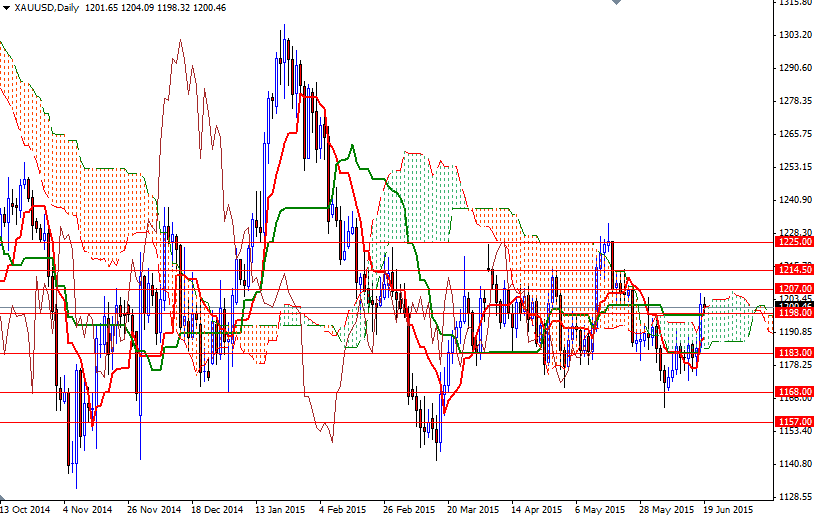

As I mentioned last week, breaking above the 1191 level improved the short-term technical picture. If XAU/USD can climb and close above the 1207 level, we might see a bullish continuation targeting 1214.50 at least. The bulls will have to capture this strategic camp in order to gain more momentum and challenge the bears on the 1231/25 battlefield. However, any failure to climb above 1207 might encourage sellers and push prices back below 1198. In that case, a retest of the 1191/0 support might be realistic. If the XAU/USD pair dives below 1190, then the 1183 level might be the next port of call.