Gold prices slipped for a third straight session on Friday as a solid U.S. payroll reading, coupled with strong growth in wages, eased concerns about the health of the world's biggest economy and revived flagging views that the Federal Reserve might consider raising interest rates as early as September. The XAU/USD pair fell to $1162.66, the lowest level since March 19, after the Labor Department reported that the economy added 280000 jobs in November, surpassing consensus estimates of 226000, and average hourly wages jumped 0.3%. Data also showed that gains for the prior two months were revised up by a total 32000.

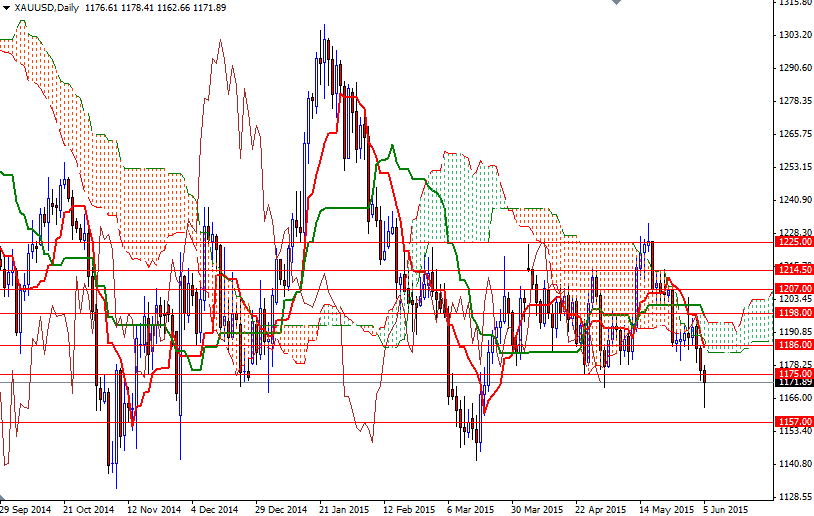

The return of stronger job growth supports the idea that the weakness in the first quarter was indeed mostly transitory but I don't think it is enough to persuade the Fed to begin normalizing policy at its June 16-17 meeting. The recent string of negative days is weakening the technical picture but Friday's long wick to the downside indicates that people are hesitant to go heavily short at the moment as the area below has been rather supportive in the past.

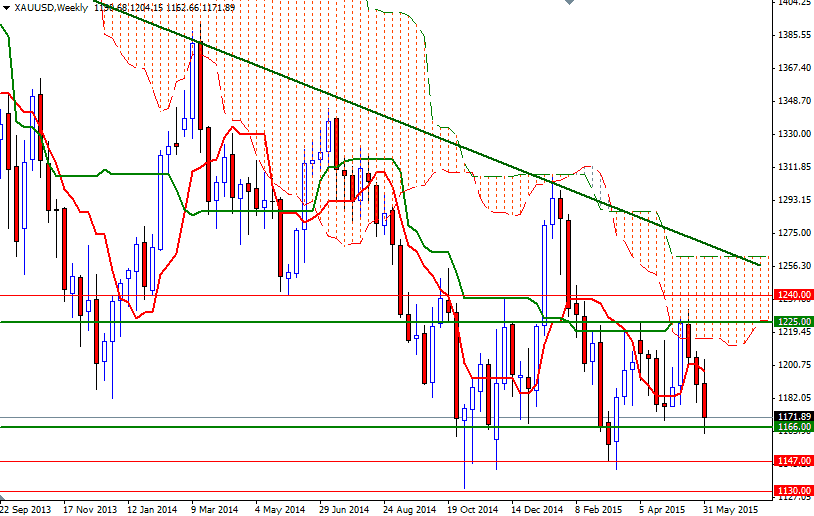

Gold prices will eventually drift down to the 1147/30 region, the question is whether or not we go higher first. In the meantime, the major equity markets will be on my radar. If Greece sparks a meltdown in European markets, the precious metal may get a temporary boost.

The bulls will need to defend their camp at 1166 and push prices above the 1175 level so that they can find enough momentum to approach the 1186/3 area where the bottom the daily Ichimoku cloud resides. Beyond there, expect to see strong resistance as the clouds (daily and 4-hour) overlap and occupy the area. In other words, anchoring somewhere above the 1198 level is essential for a bullish continuation. However, if the market makes a sustained break below the 1166 level, increasing speculative selling pressure could drag prices back to 1147 level. On its way down, support may be found at 1157. Once that critical support is broken, there is little to slow down the bears' progression until 1130.