Gold has been under pressure for a long time and this month was no different from the previous ones. With the help of the support around the $1166 level, the market tried to pass through the $1207/0 region but the bulls surrendered after the initial rally faded as buying dried up. Despite nervousness that an impasse in negotiations between Greece and its creditors could spark a massive debt default by Athens, the market struggled to gain traction.

There are too many negative factors weighing on gold such as low inflation expectations, heightened appetite for other conventional assets and increasing speculations that the Federal Reserve will begin tightening monetary policy this year. A string of encouraging reports on the health of the US economy suggests that recovery in growth after a weak start to 2015. Apparently market players believe that EU leaders can find ways to manage the potential consequences of a Greek default. However, nobody can be sure how much damage it would do to the global equity markets.

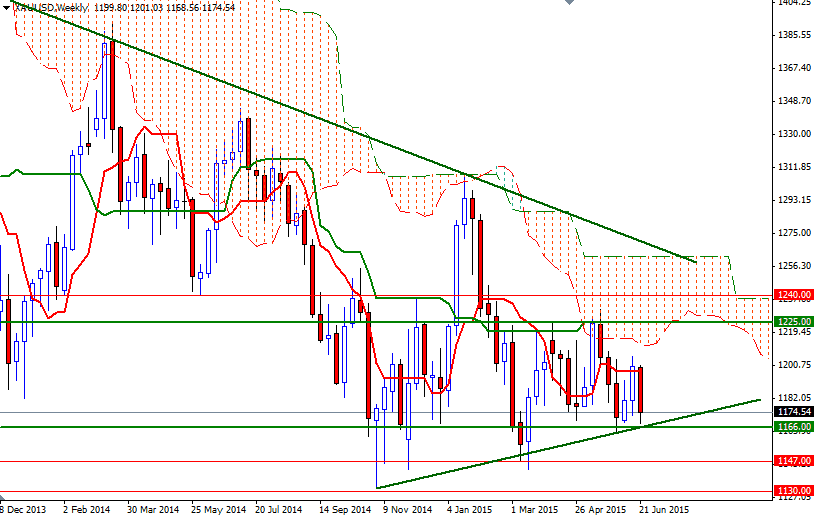

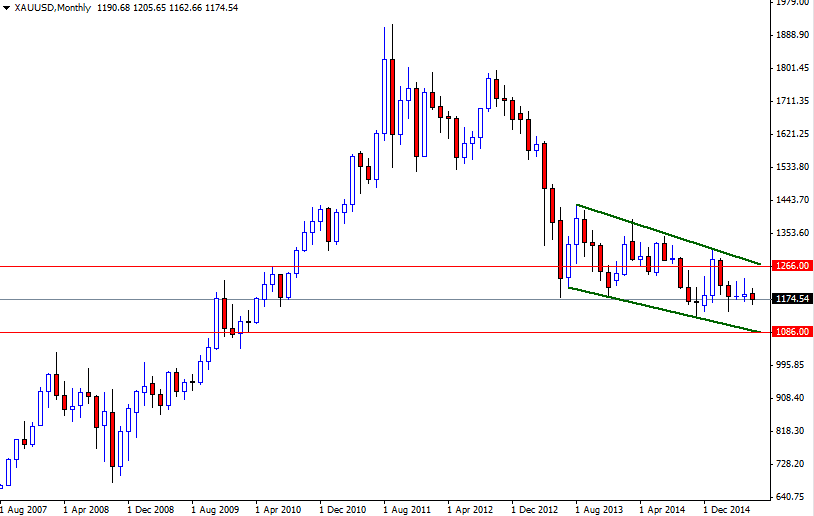

From a technical perspective, there are two things to pay close attention at the moment: the area between the 1225 and 1166 levels and the descending channel dating back to July 2013. As you can see on the weekly chart, the XAU/USD pair has found support around the 1166 level a number of times since last year so this has to be broken. In that case, the bears will probably gain enough momentum to test the critical supports at 1147 and 1130. If we can break below 1130, then prices will have a tendency to retreat towards 1086, the bottom of the descending channel. On the other hand, if buyers come back into play and prices start to rise, there will be speed bumps around 1192/88 and 1207. Beyond that, the first real challenge will be waiting the bulls at the 1225 level which also happens to be the weekly Kijun Sen line (twenty six-period moving average, green line). A weekly close above this barrier would indicate that the market is getting ready to test the 1266/1 resistance zone.