The precious metal opened with a gap to the upside yesterday as the likelihood of Greece defaulting on its debt repayment this week spiked dramatically. The European Central Bank's decision to freeze funding to Greek banks pushed down stocks on major world markets and drove up buying of safe-haven gold. The XAU/USD pair initially rallied to $1187.73 but gave up some of those gains later in the session and closed at $1179.61.

Although the initial shock faded slightly, stock markets are still under pressure. However, keep in mind that safe-haven gains tend to be short lived when the wider environment remains relatively unfriendly for gold. Weak demand for physical gold and the Fed's plans to tighten monetary policy this year will likely to prevent gold from significantly rallying as long as a serious financial instability doesn't drag equity markets around the world into a death spiral.

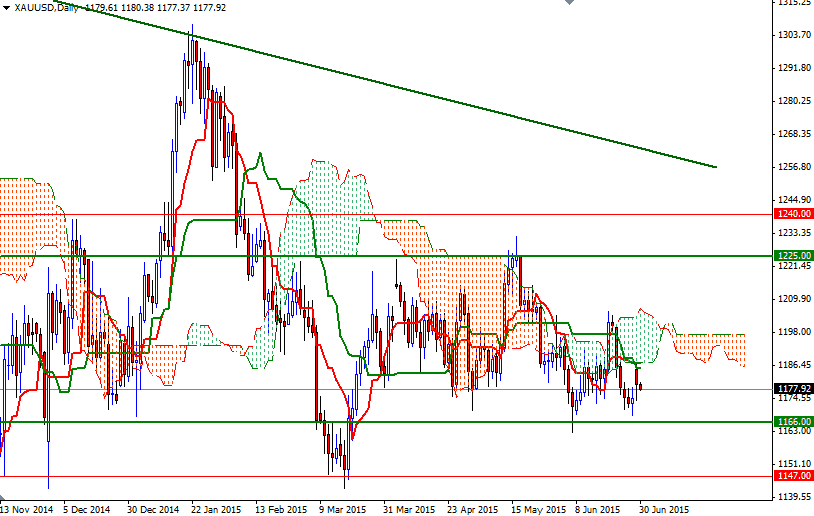

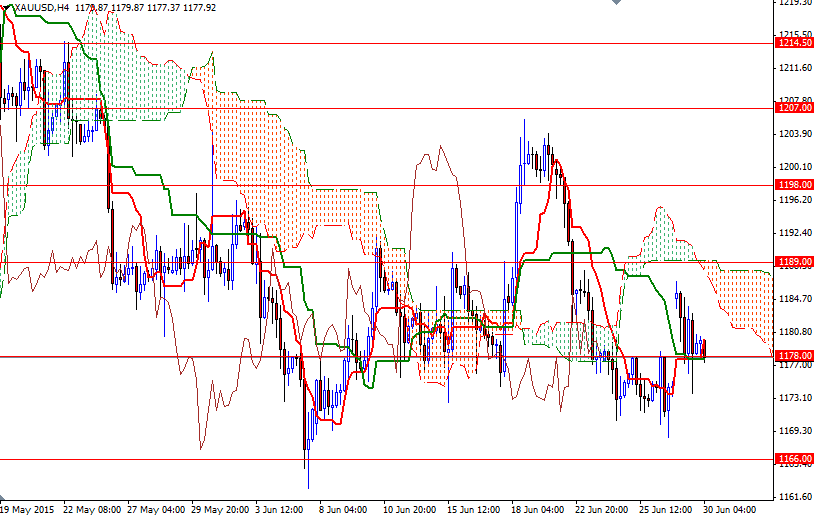

The technical picture remains bearish while the XAU/USD pair trades below the Ichimoku clouds on almost all time frames. In addition to that, the daily Chikou-span (closing price plotted 26 periods behind, brown line) is well below the cloud. Unless the XAU/USD pair makes a sustained break above the clouds on the 4-hour chart, the risk of heading back to the 1171.50 - 1170 region remains high. Below that, there is a strategic support around the 1166 level that seller have to shatter. On the other hand, if the bulls want to take over and revisit the 1202 - 1198 zone, they will need to clear a bunch of resistance levels clustering around 1189. Closing above 1202 on a daily basis would suggest that the next stop might be the 1207 level.