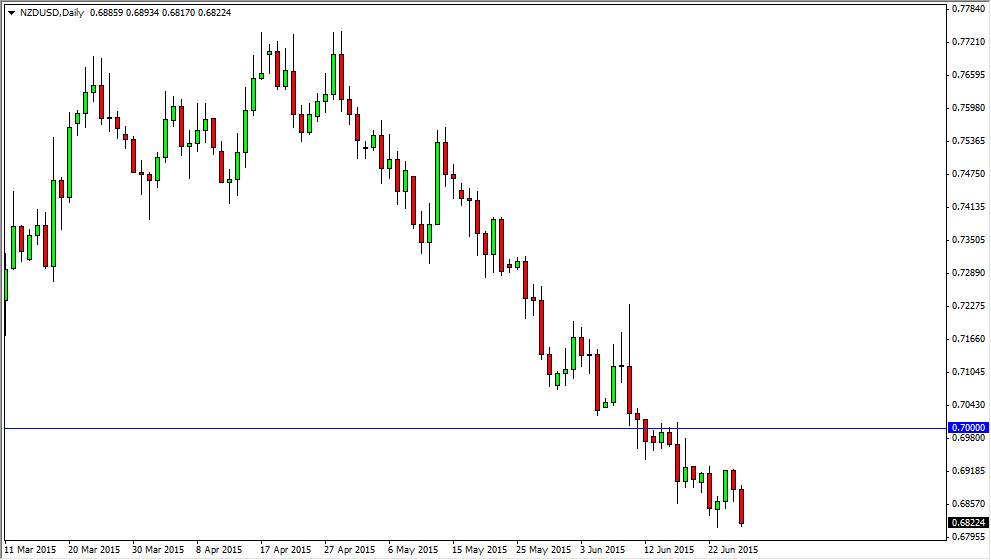

The NZD/USD pair fell hard during the session on Friday testing the lows yet again. I still believe that this market has further we go though, as the thinnest of margins keep this market above the 0.68 handle at the moment. The 0.68 level is important from historical standpoint, but even more so it has been brought into focus by the comments coming out of the Royal Bank of New Zealand several months ago about it being fair value. Recently though, central bankers out of Wellington has suggested that the 0.68 is still too high.

With that being the case, I look to the longer-term charts and I realize that the 0.65 level is fairly significant. Markets are attracted to these levels and as a result I think it’s only a matter of time before we get down there. The question then becomes how do we do it? I think we probably have short-term rallies from time to time but they will only end up being value in the US dollar.

Selling rallies

I continue to sell rallies every time they happen, and I recognize that we probably won’t have much in the way of a sustained move, because quite frankly this downtrend is very long in the tooth. However, it looks like we still have room to go, and as a result I think that this might be one of the more reliable currency pairs during the course of the summer which of course is typically very choppy. With the lack of liquidity, and the fact that the New Zealand dollar is probably one of the least liquid major currencies out there, this could be a very interesting place to put your money. I see no reason whatsoever to buy this market, at least not until we get above the 0.72 level, something that we will not be doing anytime soon. Ultimately, I think we do reach the 0.65 level and will have to assess things then.