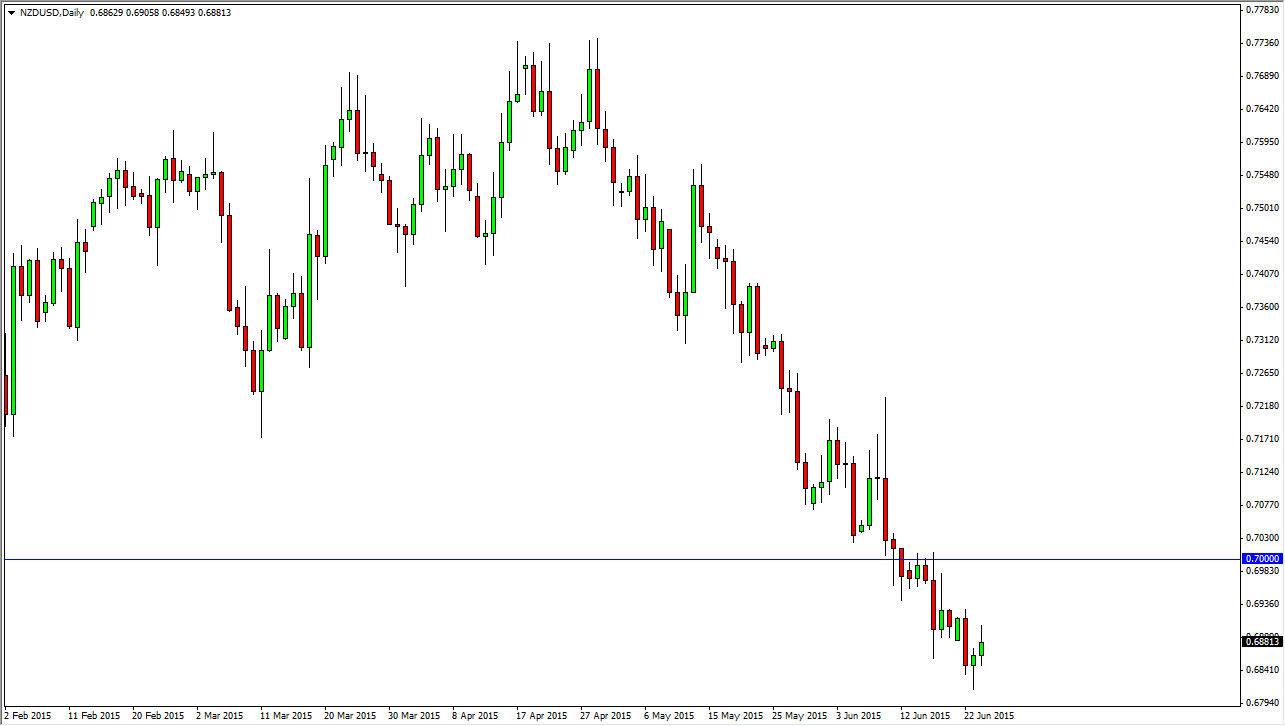

The NZD/USD pair had a bit of a rally during the session on Wednesday, but towards the end of the day we got a bit of a selloff, making what once look like a reasonable rally look very weak and uninspired by the time it was all said and done. With that, it’s very likely that we will continue to struggle and that short-term rallies will continue to be selling opportunities. This makes sense, we are in a massive downtrend, but sooner or later you would think we would have some type of rally to speak of.

The New Zealand dollar of course is highly leveraged to the commodity markets and quite frankly just the general mood of the commodity markets. With that, this is the type of candle stick that tells you just how bearish market truly is. At the very first sign of resistance, the market rolled back over. I think that will be the case going forward, and as a result I believe that the 0.70 level will be a bit of a ceiling in this market as we will struggle to get much further than that as far as a rally is concerned.

Longer-term downtrend

You have to keep in mind that we are in a much longer-term downtrend, and as a result it’s really difficult to hang onto anything as far as a rally is concerned. I think that the easy money has already been made selling the New Zealand dollar, but short-term rallies will offer small trades to the downside. On top of that, you have to keep in mind that it is the summertime, and that of course means less liquidity than usual. This is one of the least liquid pairs that is considered to be fairly major, so the fact is that summertime trading is particularly uninspired in this particular currency.

Lack of demand for commodities out of Asia certainly isn’t helping the situation, as the Kiwis rely so much on that market. With this, I believe that every time we rally it’s just going to invite selling.