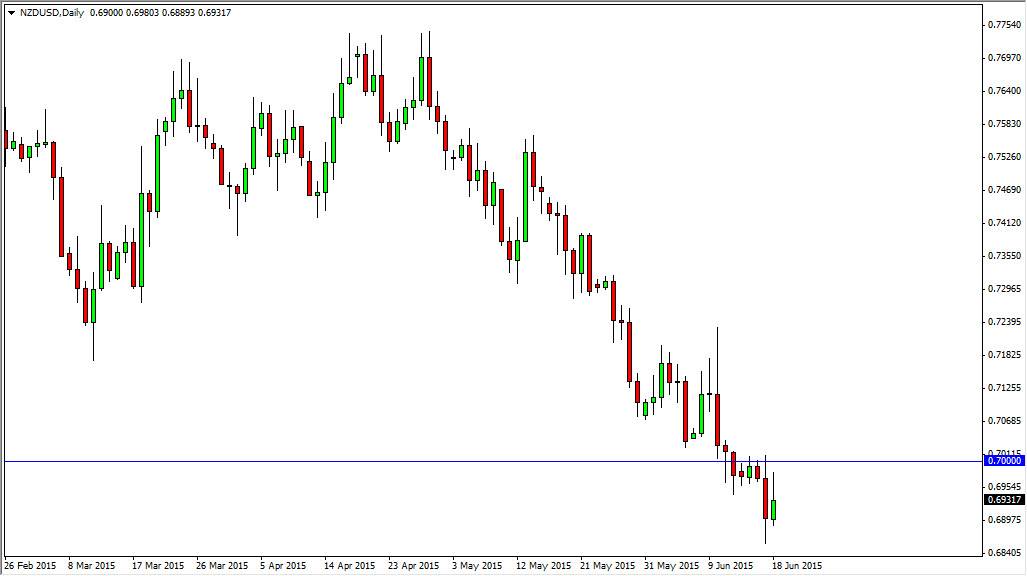

The NZD/USD pair broke down over the course of the last couple of sessions, and we have been below the 0.70 level for the last several days. However, during the Thursday session we tried to break back above that area but found the selling pressure there to be a bit too strong to break out. With that being said, we did end up pulling back in forming a bit of a shooting star at the bottom of the downtrend, which for my money is a very negative sign.

I believe that even if we managed to break above the 0.70 handle, there should be a significant amount of resistance all the way to the 0.72 level. That area should be very choppy anyway, so at this point in time I’m really not interested in buying this pair until we get above the 0.72 level, something that isn’t very likely to happen anytime soon. I believe that the markets will continue to sell off every time the buyers try to push the New Zealand dollar higher.

Too much uncertainty

I believe that there’s too much uncertainty out there for traders to want to buy the New Zealand dollar, and because of this I believe that we will continue to see sellers again and again. Also, the commodity markets aren’t exactly going to be stable either, and that of course will work against the value of the New Zealand dollar. I believe that if we break below the bottom of the shooting star, we will start to sell off yet again.

If we sell off to a fresh, new low, I think that the market then goes to the 0.65 handle, and possibly even lower. However, I think that all of the easy money selling the New Zealand dollar has already been had, so I think that more than likely we will probably see short-term selling opportunities again and again. With that being said, I am very bearish of the New Zealand dollar but also recognize that we are late in the game.