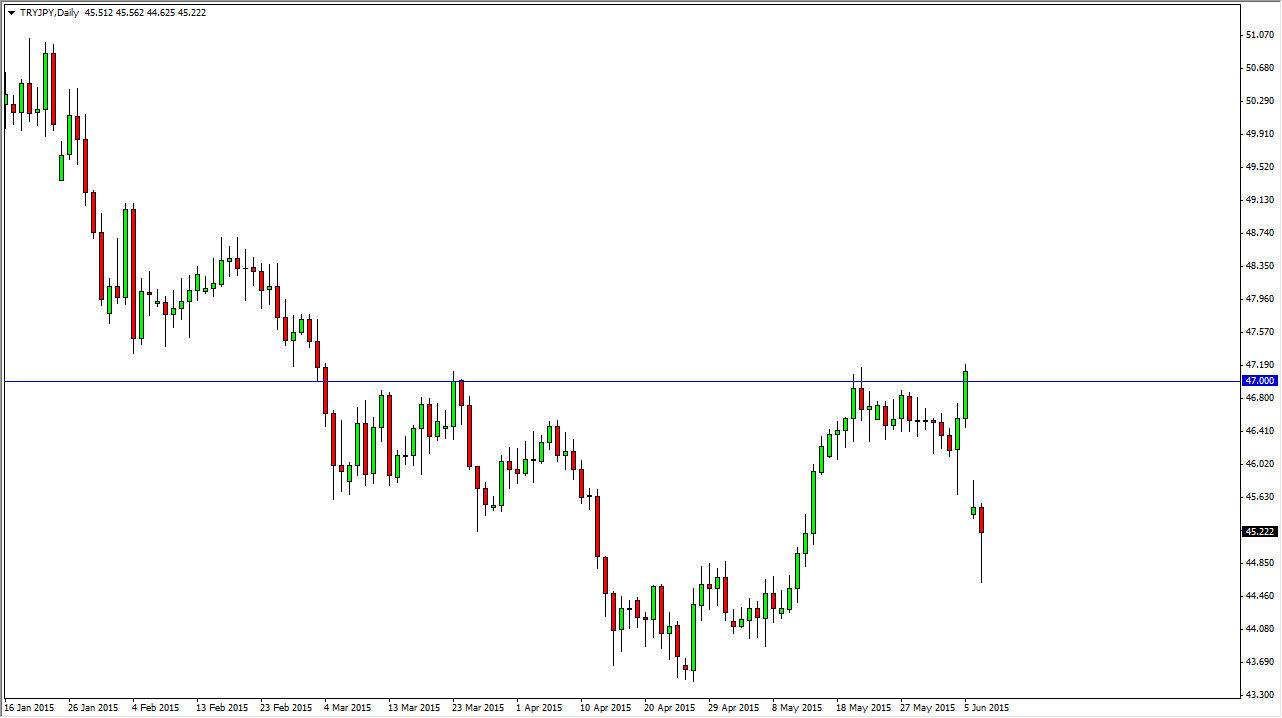

The TRY/JPY pair is one of my favorite pairs to trade because of the large swap offered for going long. Ultimately, this is a market that a lot of “carry traders” prefer as there is plenty of money to be made while waiting for a move higher. The fact that we gapped lower suggests that there are a lot of fears due to the Turkish elections. For those of you who do not know, there seems to be a bit of a struggle to come up with an idea as to how to form a coalition government in Ankara. Because of this, it will continue to have people concerned about the Turkish lira itself.

Ultimately, the gap should be filled relatively soon, as markets almost always do this, and with that I will be looking for a buying opportunity. Keep in mind that on the chart the first candle from the gap with actually the weird two-hour candle from Sunday night in North America. I believe that we will fill this gap given enough time, but the question then becomes whether or not it’s going to happen soon.

You must be patient

You have to be patient in order to trade these types of trades as sometimes it takes several days for this to happen. However, I do see a significant amount of support below, especially near the 44.50 level. That is an area where I think the buyers will come back into this marketplace, and perhaps trying to reach the 47 level with enough time.

I believe if we break above the 47 level, then we start to head towards the 49 level over the course of the next several weeks. It really will come down to what happens in Turkey, but it’s probably only a matter of time before the government can be formed, and with the way the Japanese yen has been selling off, I think it makes sense that this market would go much higher as the interest-rate differential certainly favors the Lira.