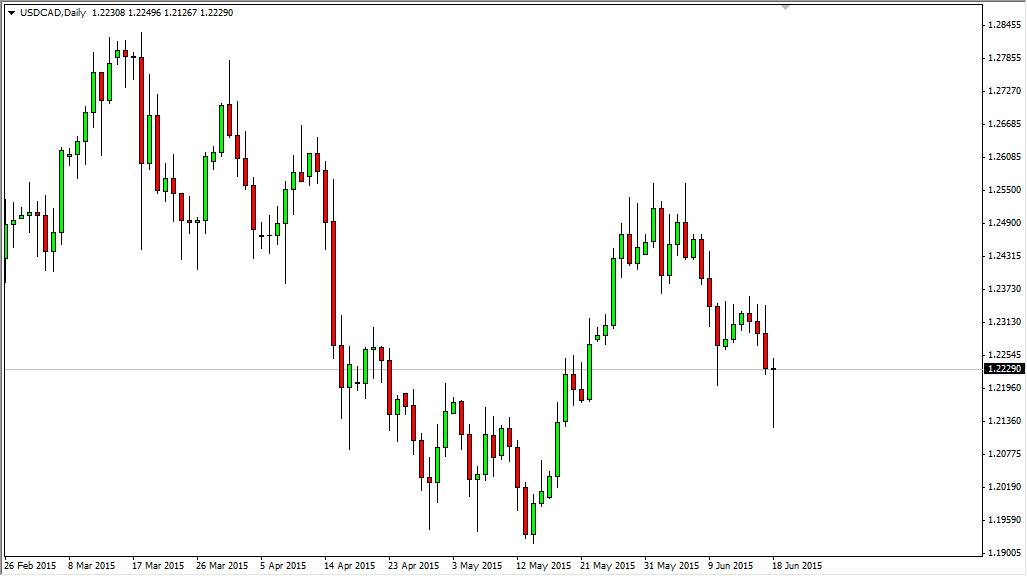

The USD/CAD pair initially fell during the session on Thursday, but as you can see found enough support below to turn things back around and bounce back above the 1.22 handle. This is a market that seems very tight to me, but I think there might be a short-term buying opportunity. Break above the top of the hammer for the Thursday session. I don’t know that the market will go above the 1.24 level though, so I am not looking to get to deep into this market, and I’m certainly not overly excited.

If we did fall from here, it would be very difficult to sell simply because there seems to be a lot of noise between here and the 1.19 level. I also recognize that the oil markets seem to be very choppy as well, and that of course will have an effect on this market as the crude oil market simply seems lost at the moment.

Looking for clarity

With that being said, I think there is a short-term buying opportunity as I mentioned before, but at the current time I don’t see anything worth hanging onto. Quite frankly, the market will probably continue to bounce back and forth until we get some type of significant move out of the oil markets, or a significant breakdown in the US Dollar Index. With this, I am only looking for short-term plays in this particular market, but since the hammer is one of my favorite signals, I have to mention it in this article.

All things being equal, I think that we will continue to trend somewhat sideways with a slightly negative bias over the course of the next month or two. This is the slowest time of the year as we are in summer, and with that I believe we are starting to see very low volatility as far as range is concerned. Choppiness on the other hand, will be quite common in my opinion.