USD/CHF Signal Update

Yesterday’s signals expired without being triggered.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be entered between 8am and 5pm London time.

Short Trade 1

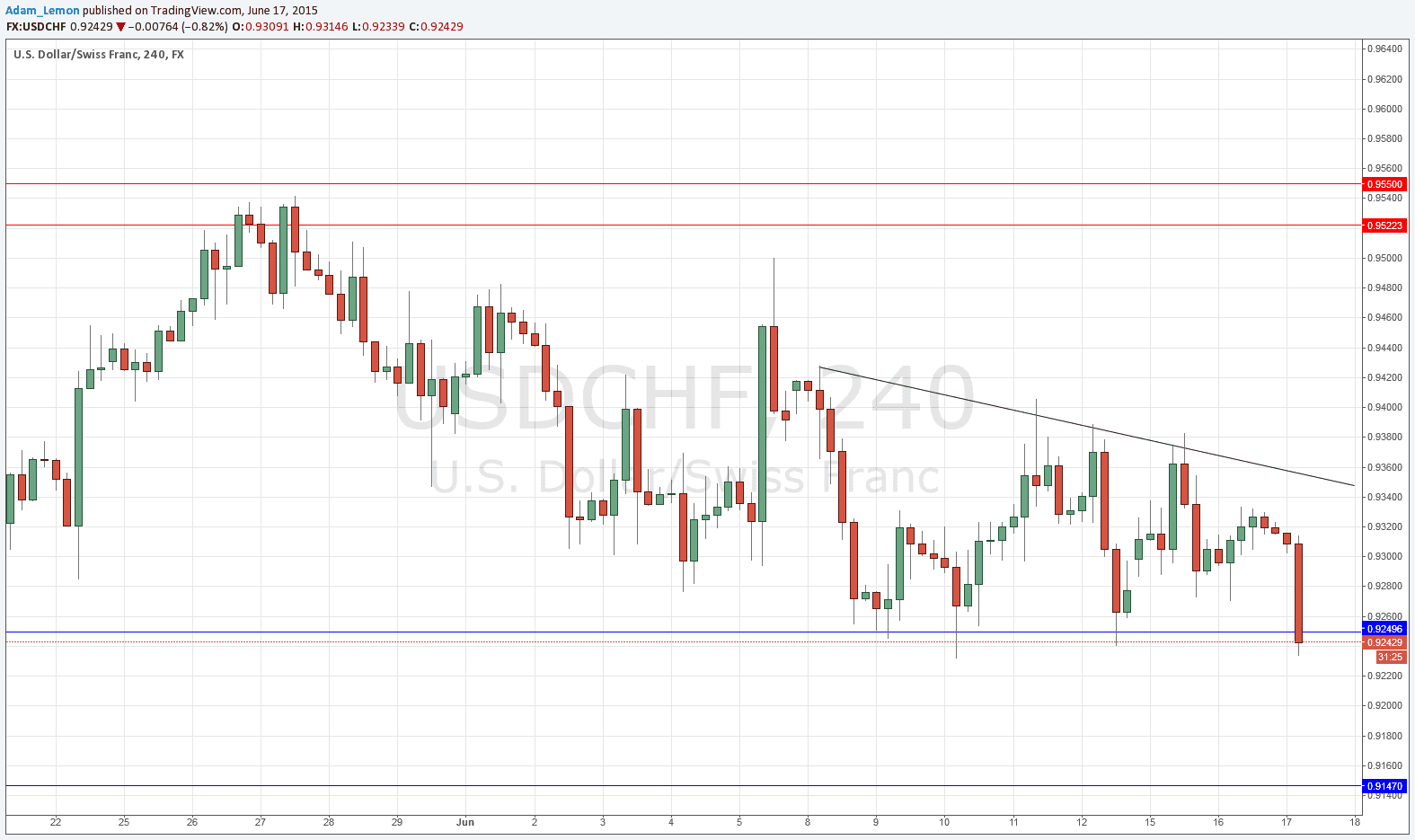

Short entry after bearish price action on the H1 time frame following the next touch of the bearish trend line currently sitting at around 0.9355.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 1

Long entry after bullish price action on the H1 time frame immediately from 0.9250.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

Again the price is trying to bash down past 0.9250 but so far it is not really getting anywhere. If the price holds with some stiffness now and starts to turn around, this could be a good low-risk long entry, but be careful.

A break down below 0.9250 can see the price fall to 0.9150 next if the FOMC news releases are not positive for the USD.

Above, the bearish trend line is intact and closer, and could provide a short opportunity later, but probably this would come into play only during the immediate FOMC volatility just after the release after the London close.

There are no high-impact events scheduled today for the CHF. Regarding the USD, there will be releases of the FOMC Statement, Economic Projections, the Federal Funds Rate and a Press Conference commencing at 7pm London time.