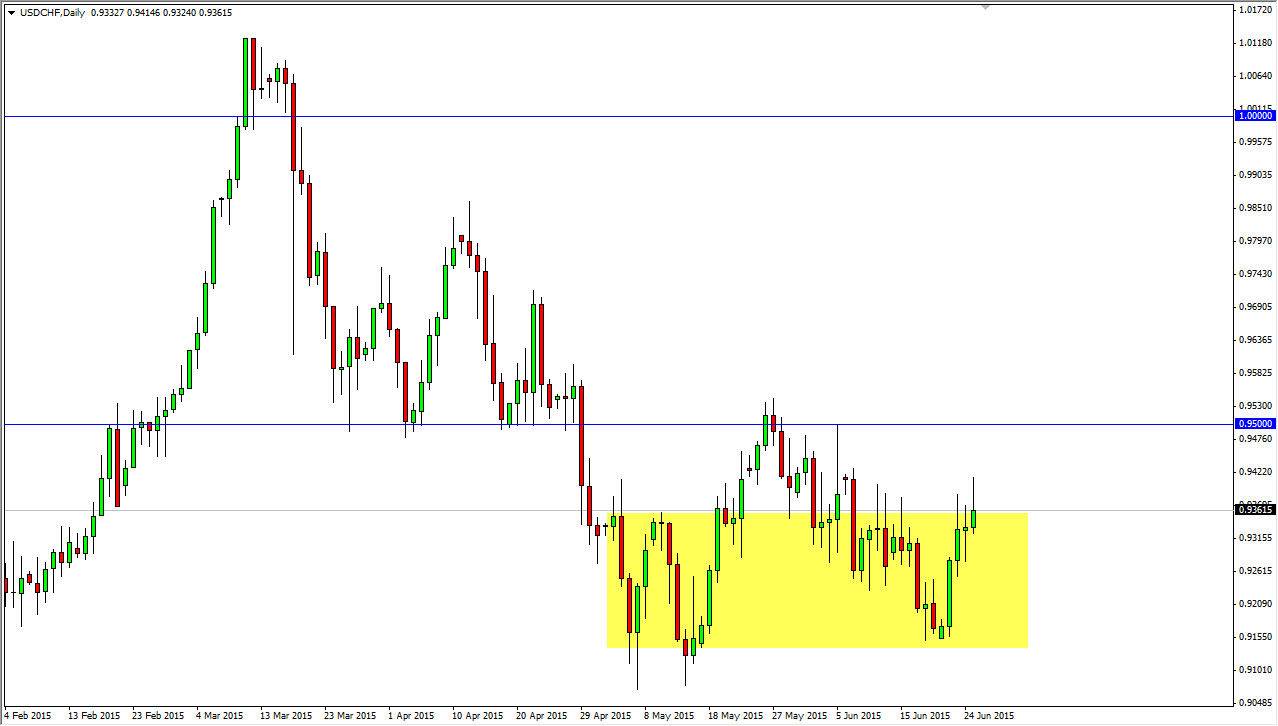

The USD/CHF pair initially rallied during the course of the session on Thursday, but turned back around by the 0.94 level. Because of this, we ended up forming a bit of a shooting star, which is based upon an obvious resistance area. In fact, the resistance runs from the 0.94 level all the way to the 0.95 level as far as I can see. With this, I think that this market could be sold if we break down below the bottom of the shooting star, perhaps for a move down to the 0.9150 region.

Having said that, you have to keep in mind that this pair tends to move in verse from the EUR/USD pair. That particular market formed a hammer for the session as well, so this is just another reason to think that we fall in this particular market.

It’s probably only a matter time before we break down a little bit lower, but I do recognize that the support near the 0.91 level is massively strong, and I think it probably extends down to the psychologically significant number of 0.90, which of course is an area that has been important in the past.

Selling rallies

I believe that selling rallies on short-term charts will be the way to go going forward overall. I don’t expect any explosive moves in this particular currency market, but I do recognize that perhaps the Swiss franc will depreciate as the Swiss National Bank leaving the quantitative easing game seems to have had very little in the way of negative effects on the Swiss economy. Because of this, people will still prefer to own the Swiss franc, at least against some of the more basic currencies.

However, if we did manage to break above the 0.95 level, I think at this point in time this market will head towards the 0.98, which of course is the next major resistance barrier. However, it does not look like we are ready to break out so I still favor selling short-term rallies.