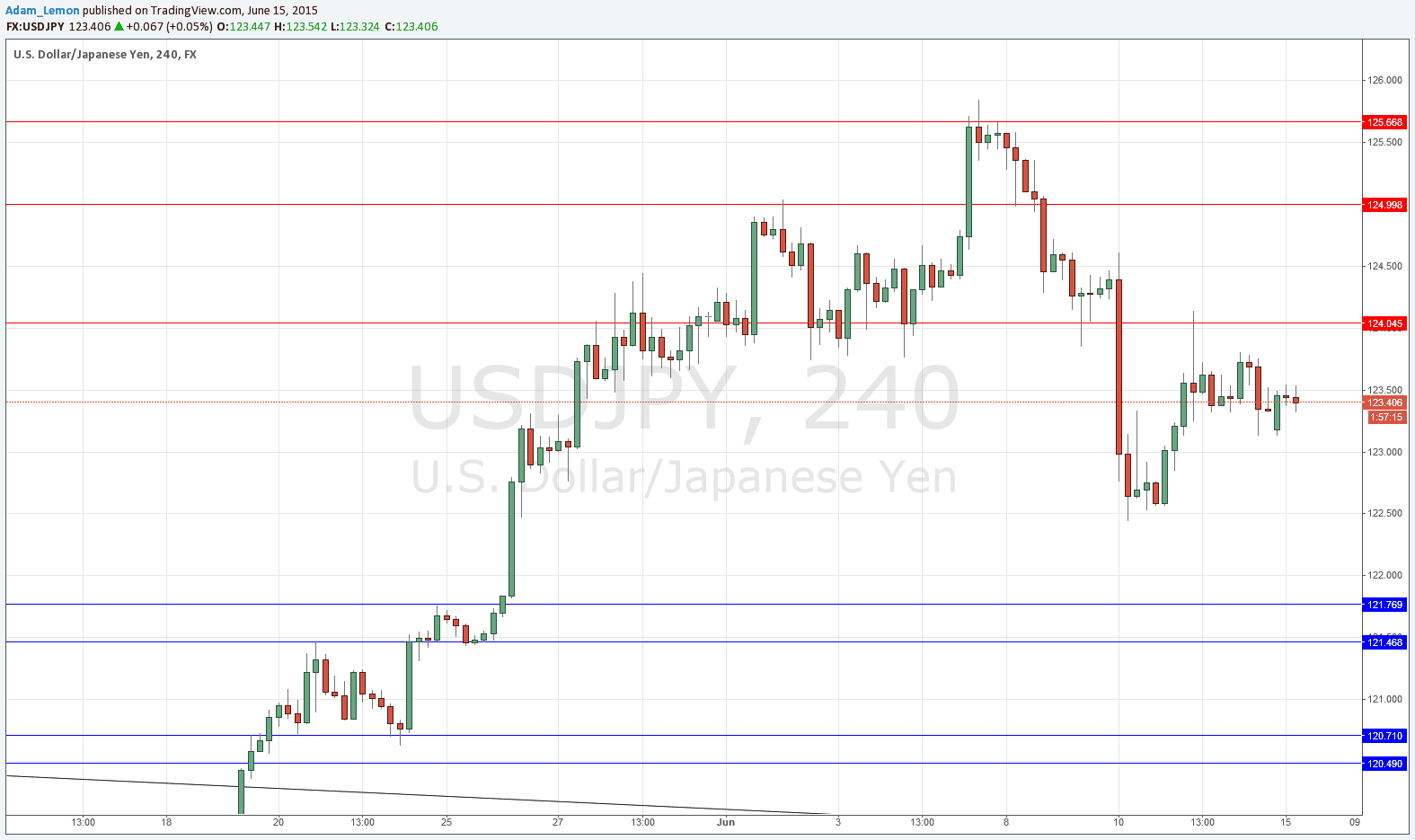

USD/JPY Signal Update

Last Thursday’s signals expired without being triggered as there was no bearish price action on the H4 chart when the price reached 123.50.

Today’s USD/JPY Signals

Risk 0.75%

Trades may only be taken between 8am and 5pm New York time only, and then after 8am Tokyo time later.

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 121.77.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 121.47.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry following a bearish price action reversal on the H4 time frame immediately upon the next touch of 124.04.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

The price has formed a double bottom at 122.50 which is arguably an important psychological number. Below this area there is probably strong flipped support as 122.00 capped the high end of a long-term recent range. The sharp fall seems to have been arrested, however support flipped to resistance overhead confluent with 124.00 and this is a potentially bearish sign suggesting that we will continue to move down to at least 122.50.

There are no high-impact events scheduled today for either the JPY or the USD.