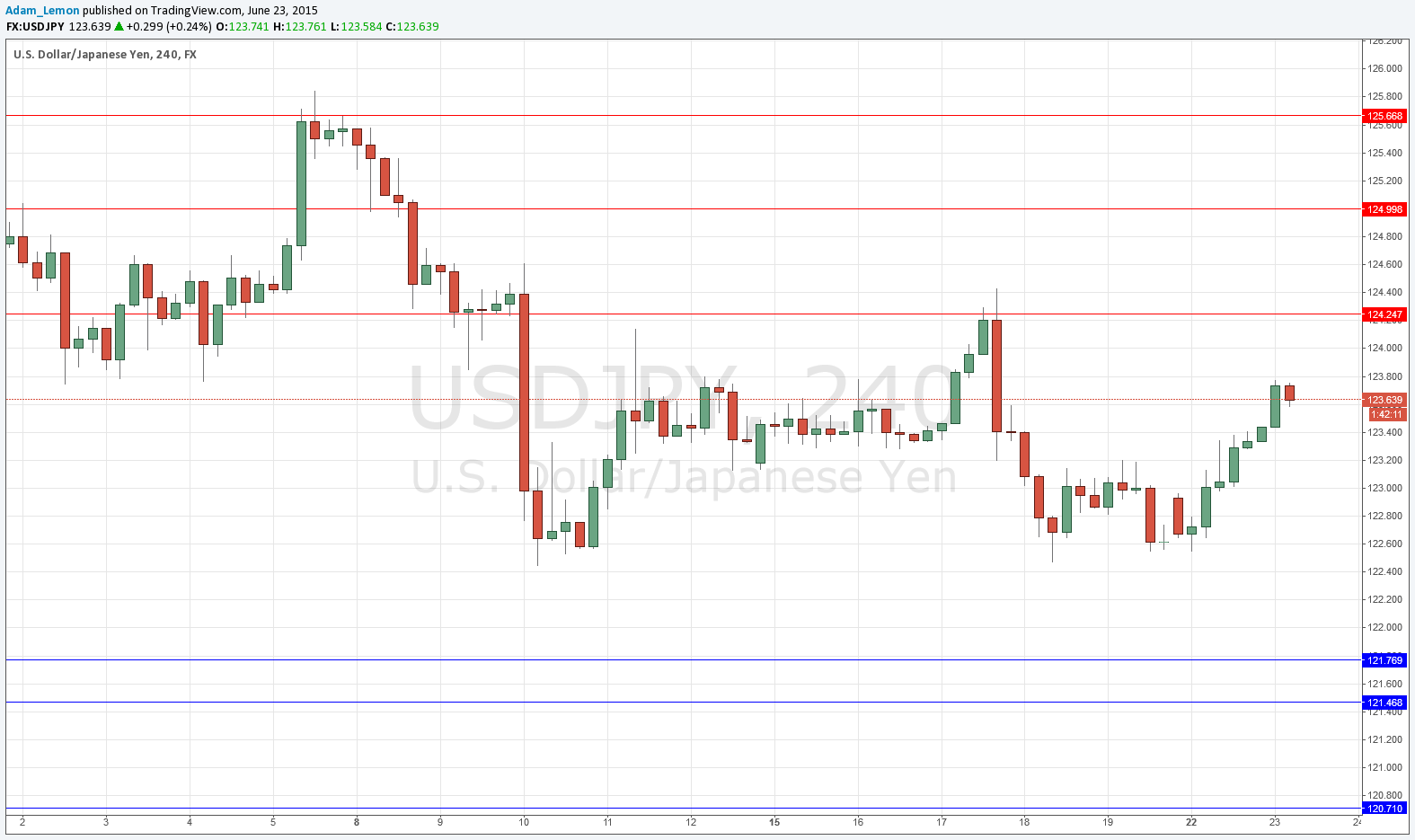

USD/JPY Signal Update

Yesterday’s signals expired without being triggered.

Today’s USD/JPY Signals

Risk 0.75%

Trades may only be taken between 8am and 5pm New York time only, and then after 8am Tokyo time later.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 121.77.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 121.47.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 124.25.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

The price moved up yesterday, in line with the general strengthening of the USD, and this continued during the Asian session. However at the end of the session the move reversed somewhat.

We are still not close to any key levels and actually are sitting at the time of writing right in the middle of the 122.50 to 124.25 range that has been established over the last couple of weeks.

There are no high-impact events scheduled today for the JPY. Regarding the USD, FOMC Member Powell will be speaking at 3pm London time, followed half an hour later by Core Durable Goods Orders data.