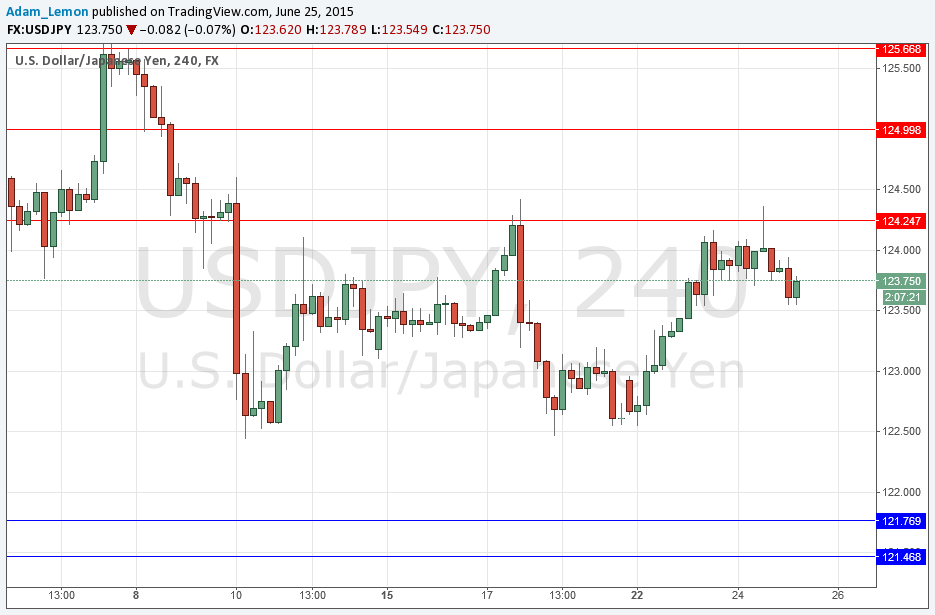

USD/JPY Signal Update

Yesterday’s signals may have provided a profitable short trade off the bearish reversal at around 124.25. It would probably be wise to close anything left from this.

Today’s USD/JPY Signals

Risk 0.75%

Trades may only be taken between 8am and 5pm New York time only, and then after 8am Tokyo time later.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 121.77.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 121.47.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 124.25.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

As forecast, the level at 124.25 did act as resistance, although it was elastic and the price made a high above it at 124.37 before turning around and falling fairly rapidly.

Choppy summer conditions seem to be prevailing everywhere, and this pair is still ranging between 122.50 and 124.30 or thereabouts.

There are no high-impact events scheduled today for the JPY. Regarding the USD, there will be a release of Unemployment Claims data at 1:30pm London time.