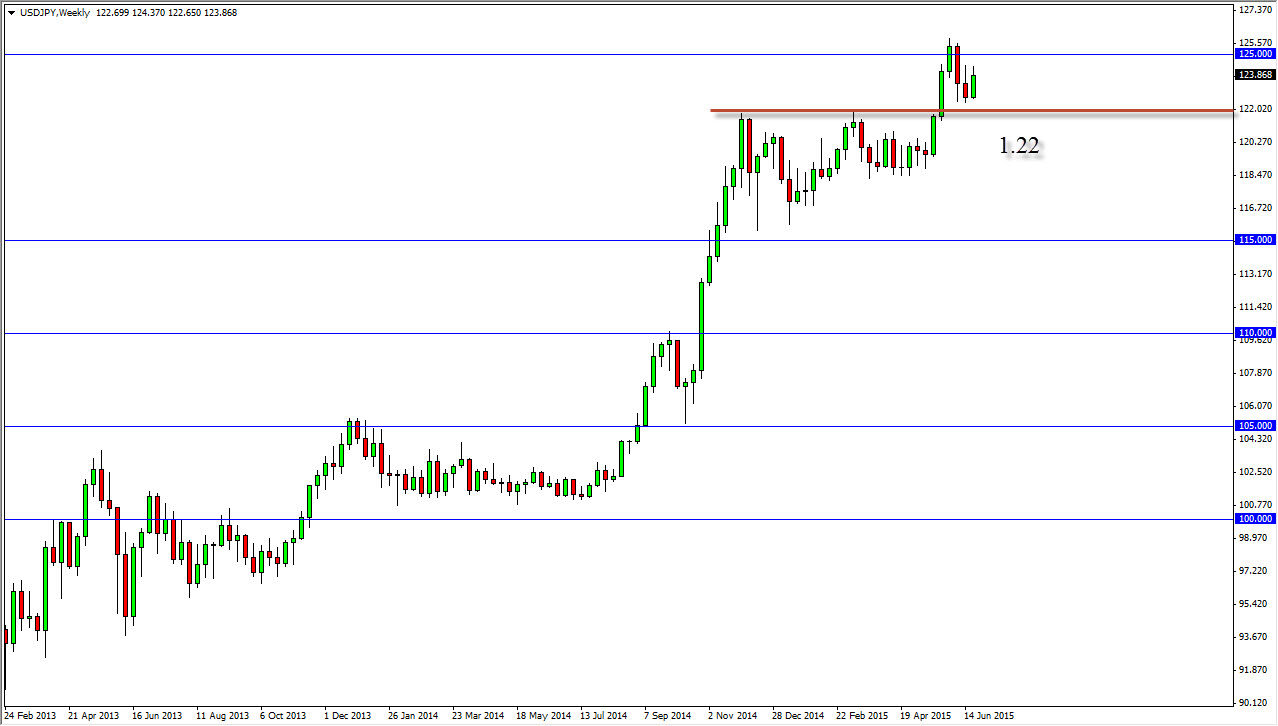

The USD/JPY pair has been very positive over the last several months, and as a result I am still bullish of this market. However, June has seen a little bit of a stumble near the 125 handle. That makes sense though, as it is a large, round, psychologically significant number. However, I believe that the pullback is simply a buying opportunity in a market that is very strong.

You can see on the chart that I have drawn a resistance line at the 122 level. This was the top of an ascending triangle, and typical technical analysis suggests that measuring the top of the triangle to the bottom of the triangle gives you the approximate size of the move that should happen. Now that we have broken above the top of the triangle, the 700 pips can be added to the 122 level. That gives us a target of the 129 level, which is the longer-term target. Quite frankly, I think 130 is the actual target.

Interest-rate differential

I believe that interest-rate differential still will come into play as far as is market is concerned, but the fact that we had such significant resistance in the middle of the summer probably gives us a little bit more weight than we should be seeing. With that, I feel that buying dips will be the way going forward, as I believe the longer-term move still has plenty of way to go.

Every time this market pulls back, I started thinking of the US dollar as being “on sale”, and therefore I like to buy. The Japanese yen will continue to suffer at the hands of the Bank of Japan, as they liquefy the markets via bond purchases and buying ETFs in the Nikkei in order to support the stock markets in Japan. With fact, the market looks as if it should continue to favor the US dollar as we already know that the Federal Reserve has at least one interest-rate hike coming sometime later this year.