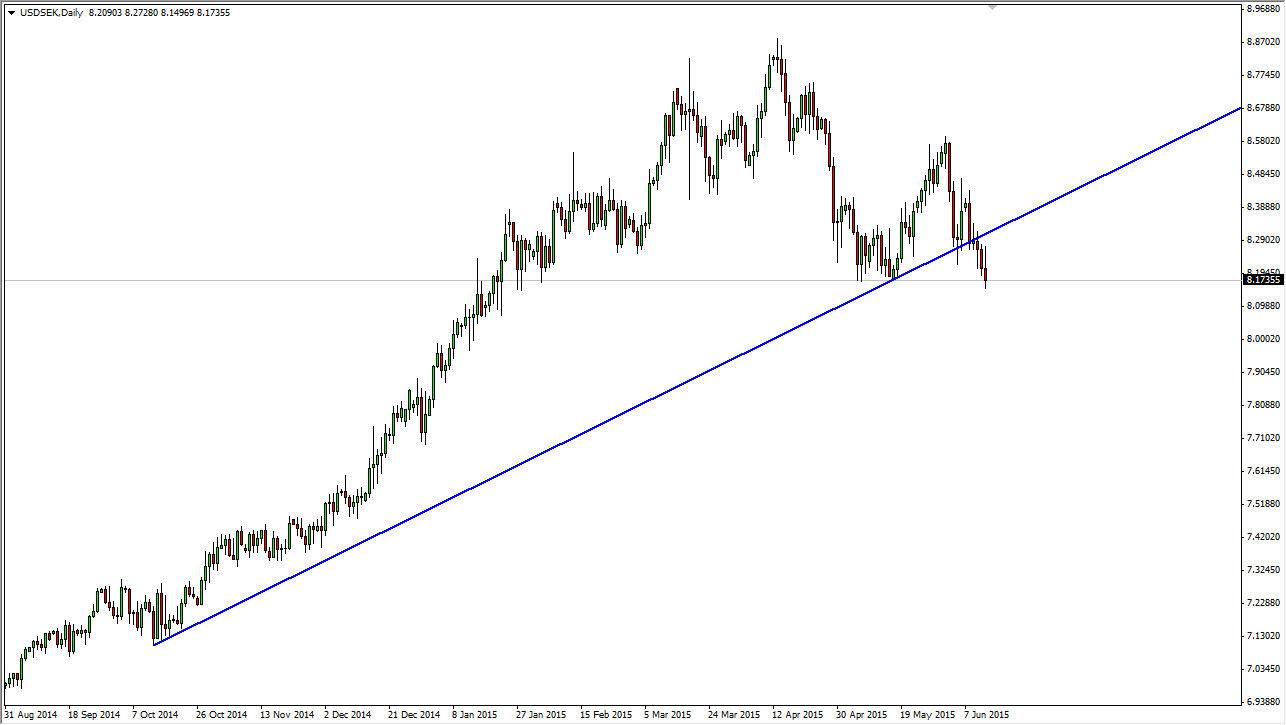

The USD/SEK pair looks very vulnerable after trading on Friday, as we initially tried to rally but found the 8.29000 level to be a bit too resistive. Because of this, we ended up forming a shooting star which of course is very bearish. However, what I find truly interesting is that somewhere near the 8.15000 level, we have significant support. If we can break down below there, I feel that the trend will change and we should probably go all the way down to the 7.50000 level. That would be a massive move, and quite an opportunity to get long of the Swedish krona.

Looking at this chart, we have broken below an uptrend line, so that of course is bearish, and I also believe that you could make a little bit of an argument for a head and shoulders been broken to the downside if we break below the supportive level that I am talking about.

Continued volatility

Even if we do break down cleanly, I think that we will have quite a bit of volatility going forward, and as a result you will have to be able to handle a longer-term trade if you start shorting. If we break above the uptrend line again, then I think that would be very bullish sign and I might be able to start buying at that point. However, I have to mention that the USD/NOK pair did pretty much the same thing during the session as well, and the Scandinavian currencies do tend to move in tandem for the most part, even though the Norwegian krone is considered to be a petroleum influenced currency.

Ultimately, I am going to wait to see where we close on Monday, but if we are lower I am going to start selling. On the other hand though, if we somehow managed to break above the uptrend line we would not only break back above that line, but break through the top of the shooting star which of course is bullish in and of itself.