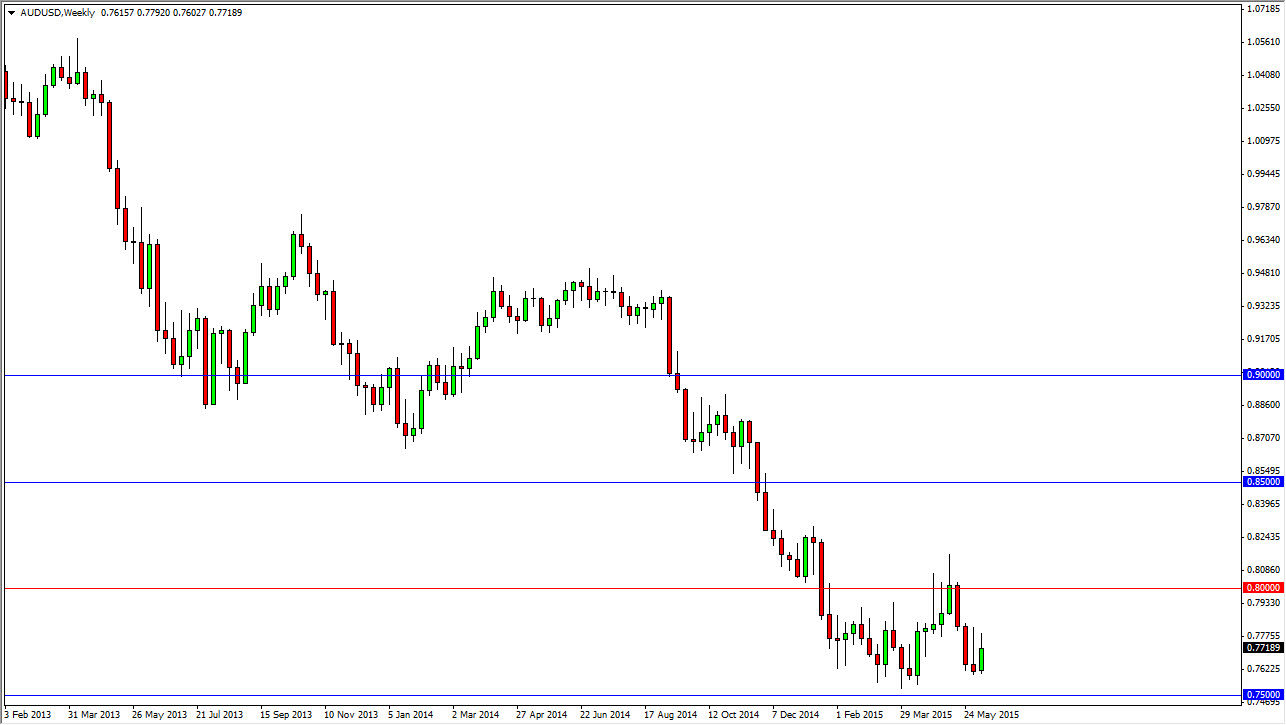

AUD/USD

The AUD/USD pair broke higher during the course of the week, but remains well within the consolidation that we’ve seen for some time. It is because of this that I am actually avoiding trading this market right now because there far too many areas that can cause us problems. I recognize that the 0.80 level above is a massive barrier to the upside, just as the 0.75 level is a massive barrier to the downside. Quite frankly, I think we bounce around erratically.

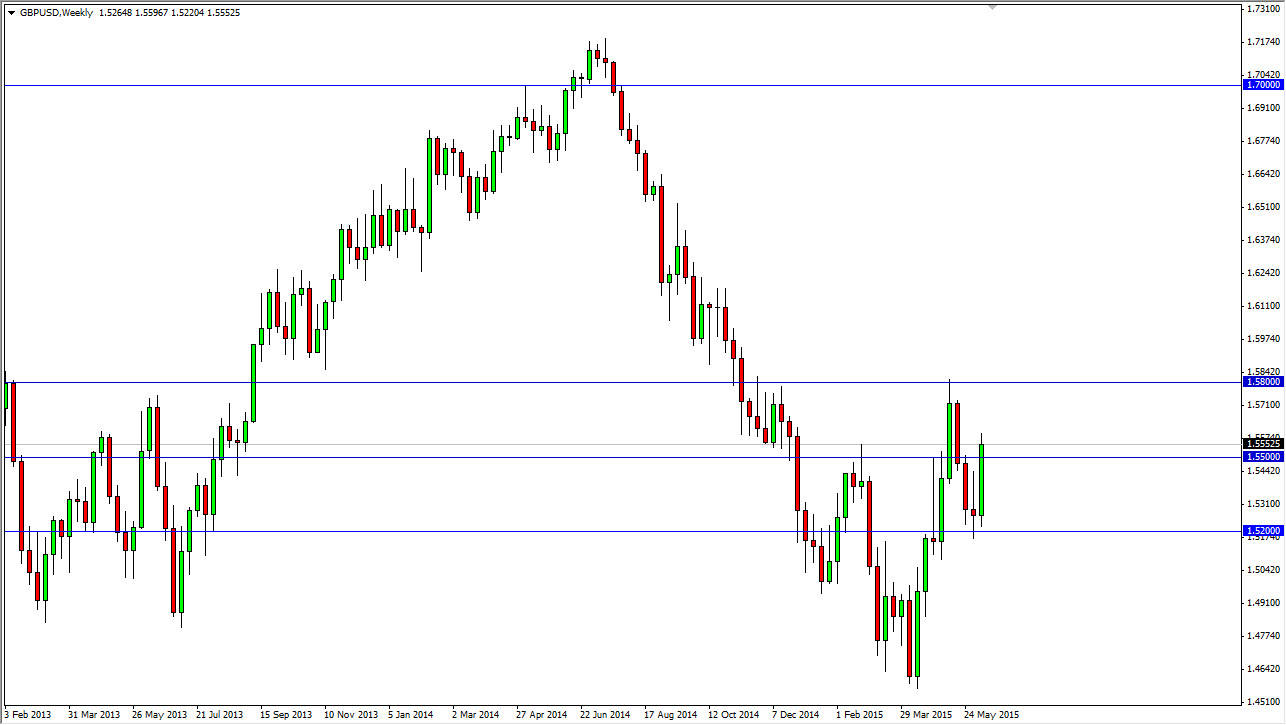

GBP/USD

The GBP is one of my favorite currencies at the moment. The fact that we broke above the 1.55 level is strong, and even more impressive is the fact that we broke above the shooting star from the previous week. Because of this, I feel that the market heads to the 1.58 level given enough time. Once we get above there, we should go much higher, probably reaching the 1.70 level. Pullbacks will be buying opportunities during the week in my opinion.

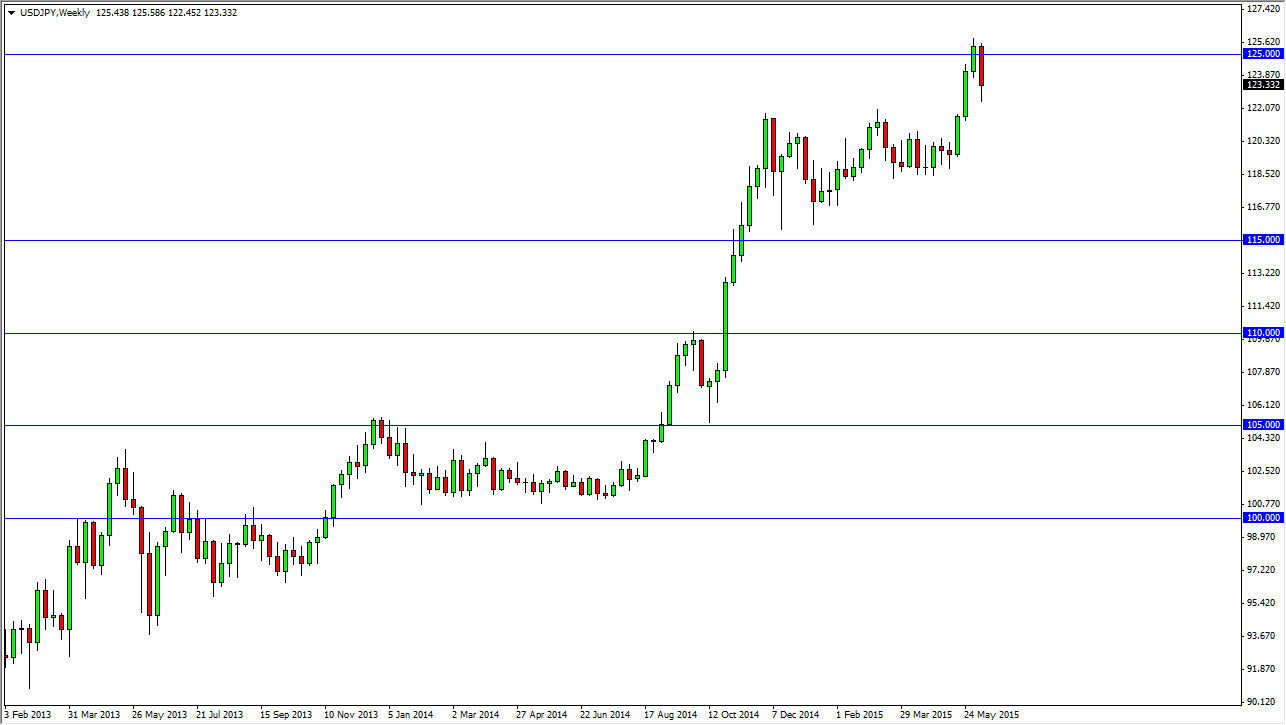

USD/JPY

The USD/JPY pair fell during the course of the week, proving that the 125 level is going to be a bit too resistive. By doing so, we crashed into the 123 handle. I believe that there is a significant amount of support near the 122 handle, and the 121 handle. With this, I like buying supportive candles every time we dip, and I do think that eventually we break out to the upside. That doesn’t mean that is going to happen right away, but I am positive and bullish of this pair over the longer term regardless. I buy value.

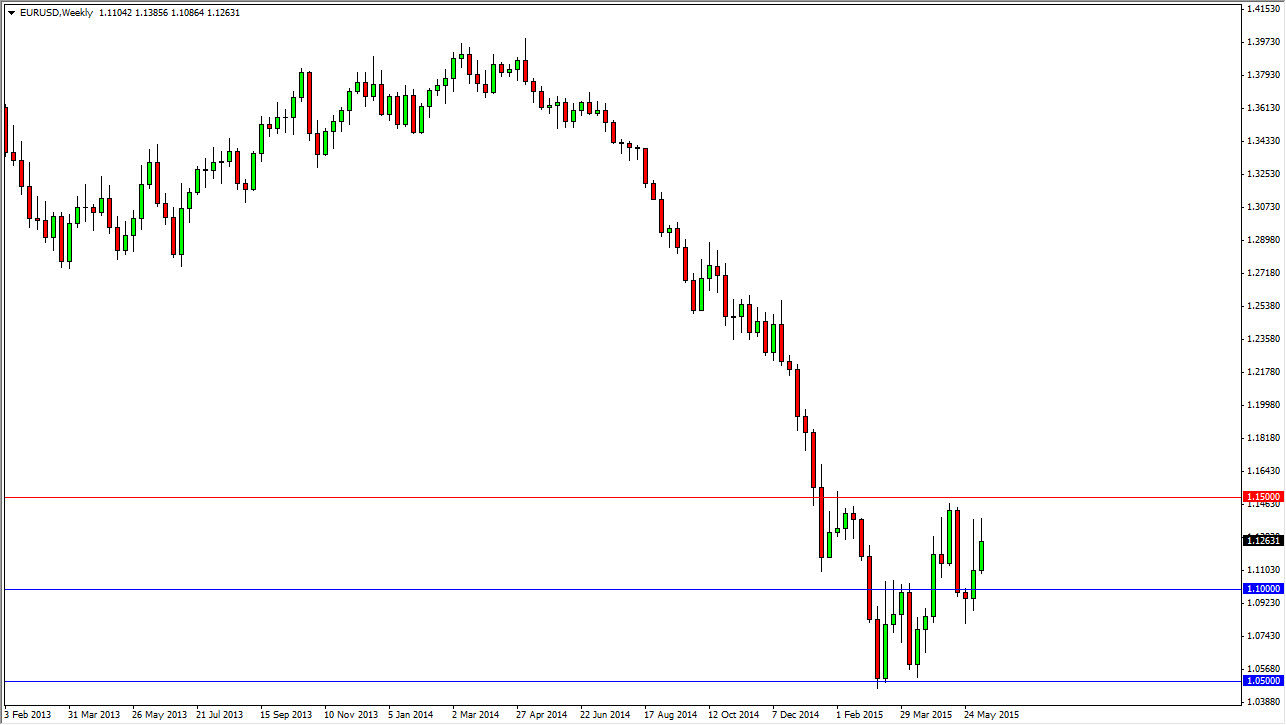

EUR/USD

The EUR/USD pair broke higher during the course of the week, testing the 1.14 level for resistance yet again. What’s interesting to me is how many hammers are appearing on the daily chart. Because of this, I am buying dips in this pair going forward and realize that the market is probably still bullish overall. If we can break above the 1.15 handle, I am massively bullish and start to become “buy-and-hold.”