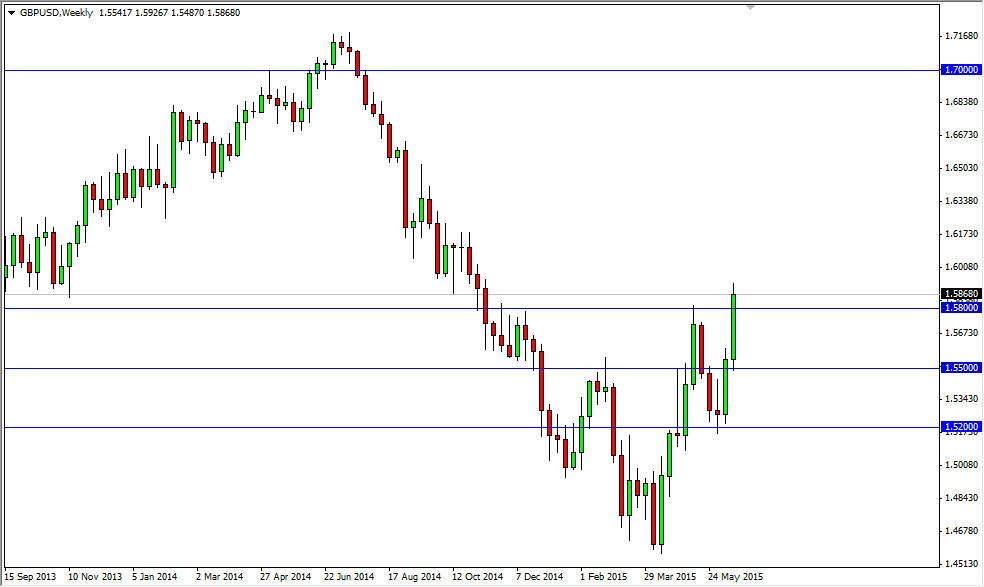

GBP/USD

The GBP/USD pair initially tried to fall during the course of the week but found so much support at the 1.55 level that we were rocketed much higher. On top of that, the 1.58 level above was significant resistance and we broke above there. With that, I believe that the market continues to go higher, probably targeting the 1.60 level next, and then higher than that. I believe that the trend has just about changed, and therefore I am very bullish of the British pound going forward.

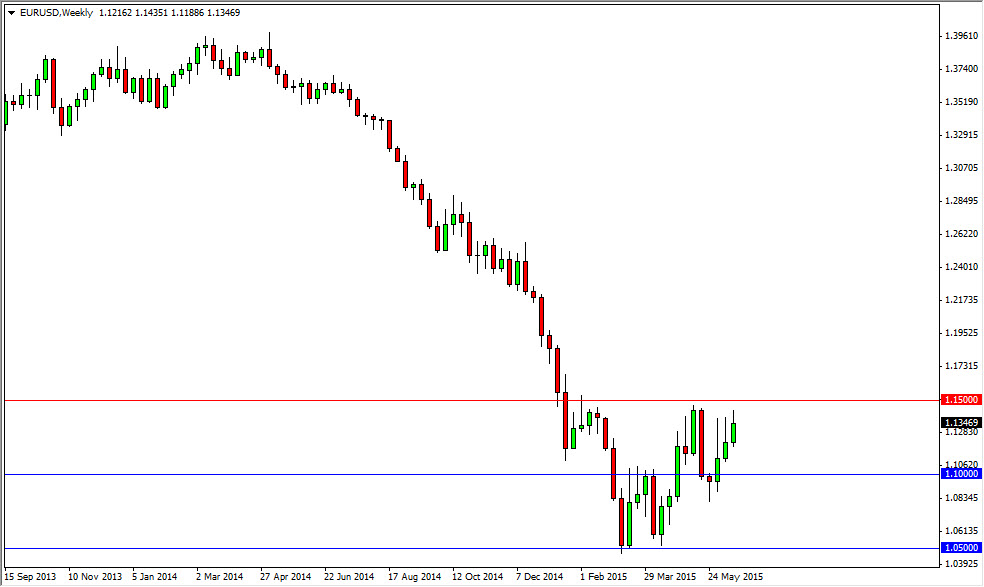

EUR/USD

The EUR/USD pair broke higher during the course of the week, as we broke above the 1.14 level during the candle. However, the 1.15 level is all we need to break above in order to truly break out to the upside, and at that point time I feel that the market goes much higher. I continue to buy dips, and I believe that the market certainly is well supported just below. It has been a tenacious move higher and it seems like that will continue.

USD/CAD

The USD/CAD pair broke down during the course of the week, and then bounced significantly. However, even though we formed a hammer in this pair, I believe that there is a significant amount of resistance at the 1.24 level, extending all the way to the 1.28 level. This was previous consolidation, but we would have to break back into that region to have me considering buying. With that, although I recognize that the hammer is very strong, the truth of the matter is I don’t think we have enough room to move and therefore I’m not interested.

NZD/USD

The NZD/USD pair broke down during the course of the week, but now that we are below the bottom of the shooting star from last week, and the 0.70 level, I believe that this market will then try to get down to the 0.68 level, and then the 0.65 handle. Ultimately, I don’t have any interest whatsoever in buying this pair until we get above the 0.72 handle, something that probably won’t happen this week.