EUR/JPY

The EUR/JPY pair went back and forth during the course of the week, confirming that we are consolidating. I believe that the 141 level on the top is the resistance, and the 137 level on the bottom is supportive. I think that more than likely we will break out to the upside, and I see enough support at 136, 135, and even 134 to keep me from selling in general. I am a buyer on dips.

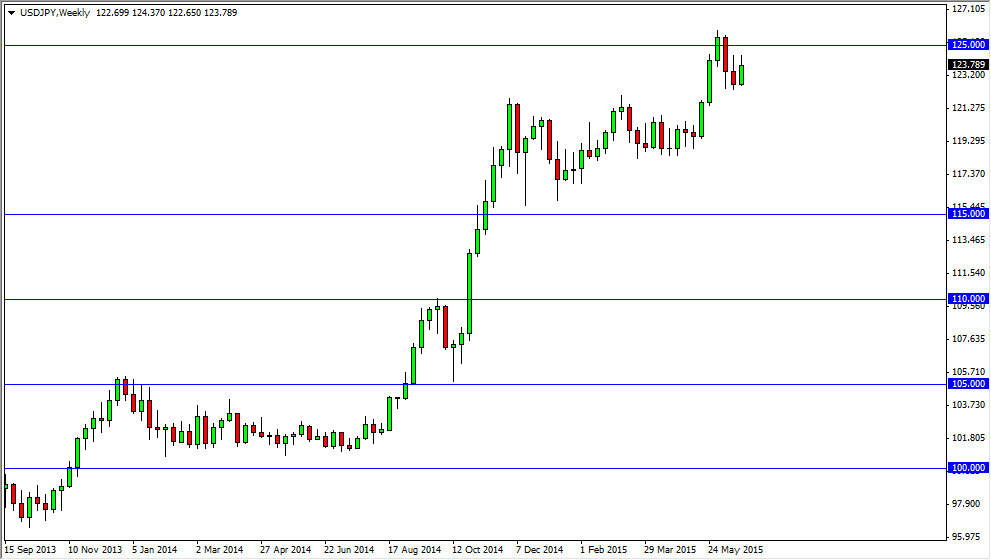

USD/JPY

The USD/JPY pair did have a positive week, as we bounced off of the 122.50 level again. However, I think that it’s only a matter time before we break out anyway, so the only thing I am doing in this market is buying. I believe that the 121 level is massively supportive as well, and that the market will eventually break above the 125 resistance barrier, and become more of a “buy-and-hold type of situation. I continue to buy this pair.

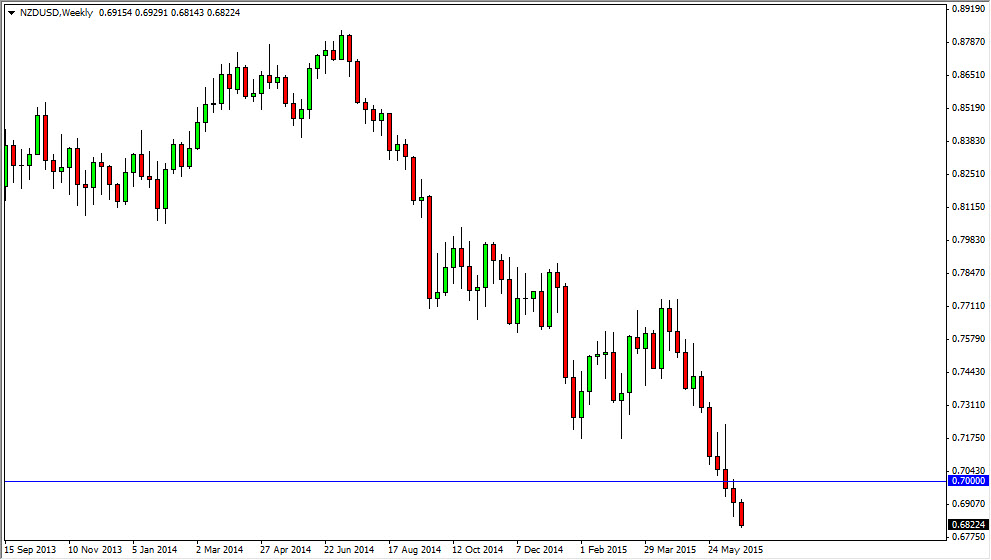

NZD/USD

The NZD/USD pair did something that I didn’t think it was going to do right away: make fresh new lows. With that, I believe that the market will eventually break down below the 0.68 handle and head towards the next obvious support level at the 0.65 level. The New Zealand dollar continues to suffer in general, and as a result I plan on selling every rally that we have going forward until we can break above the 0.72 level, so that looks very unlikely at this point in time as this is one of the most negative currencies in the world right now.

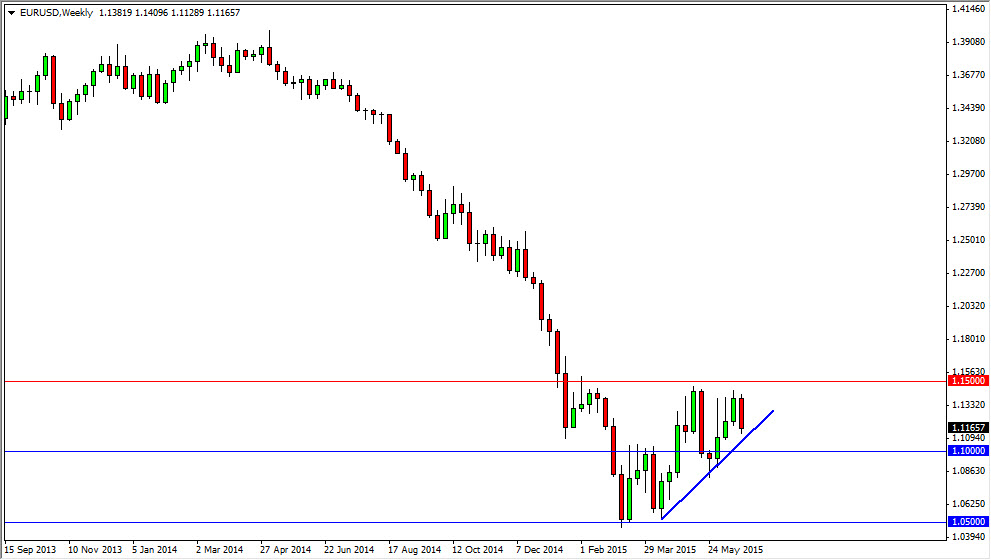

EUR/USD

The EUR/USD pair fell during the course of the week, but as you can see I have an uptrend line on this chart that still looks like it’s in play, and I also believe that on there we have the 1.10 level being fairly supportive. With that, I am only buying this pair but I think it’s only a matter of time before we not only bounce, but we break out above the 1.15 level which I see as a major trend change. With all this drama in Greece, a lot of people are concerned, but quite frankly it’s always worked out in the past and there’s no reason to think that it won’t now. The Euro is oversold.