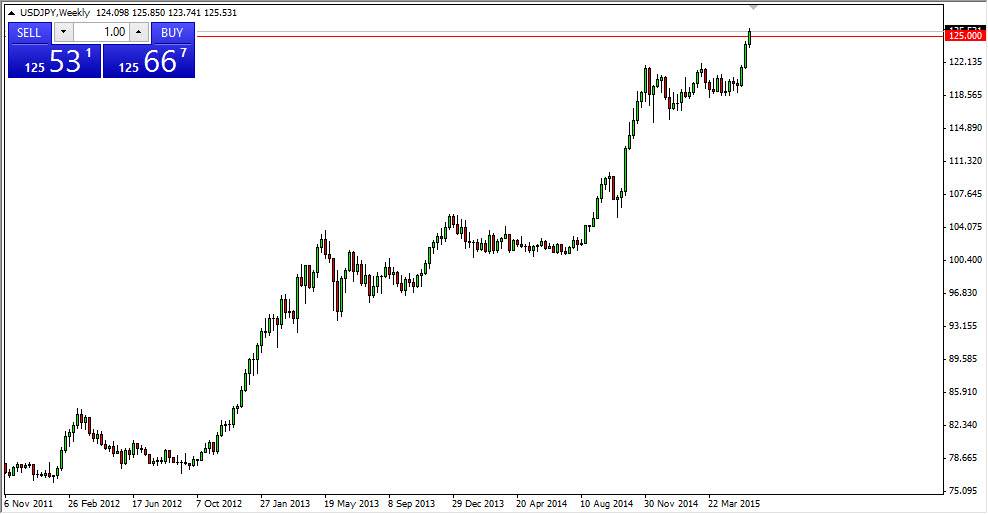

USD/JPY

The US dollar finally broke above 125 yen to show about the longer-term trend will continue. Because of this, I am a buyer of the USD/JPY every time it pulls back to the 125 region, and possibly even lower than that. In fact, I see quite a bit of support only down to the 124 level, and as a result this is essentially a “buy only” type of market. With that, I believe that this is probably the easiest rate take as the Bank of Japan continues to flood the market liquidity as they continue to buy Japanese Government Bonds.

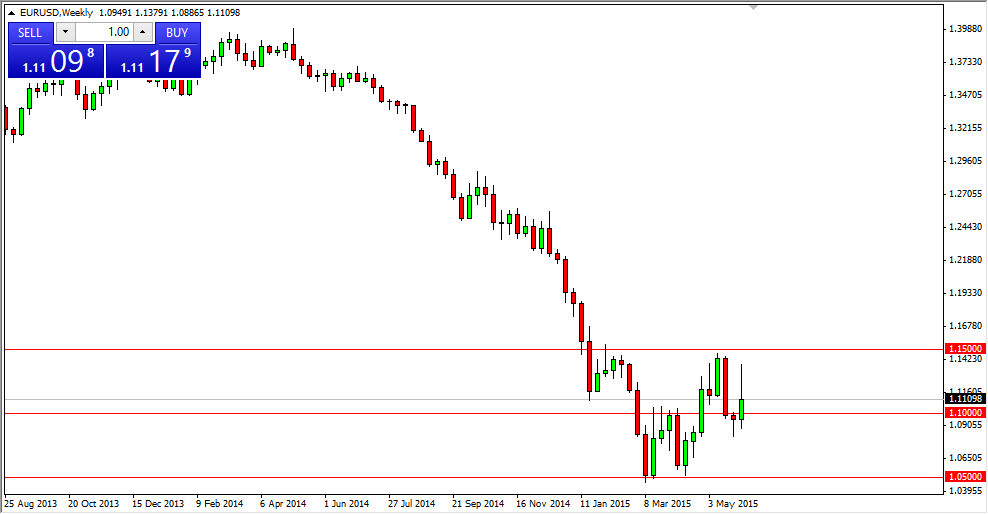

EUR/USD

The Euro had a slightly positive week, but did initially look like it was going to take off. Ultimately though, I believe that is going to be the case going forward, a lot of sideways chopping and volatility. Once we get above the 1.15 level, then he becomes more of a “buy and hold” type of situation. In the meantime, I anticipate the market to bounce between the 1.10 level and the 1.14 level as we have done so recently. Summer trading will of course be a bit of a drag on volatility as well.

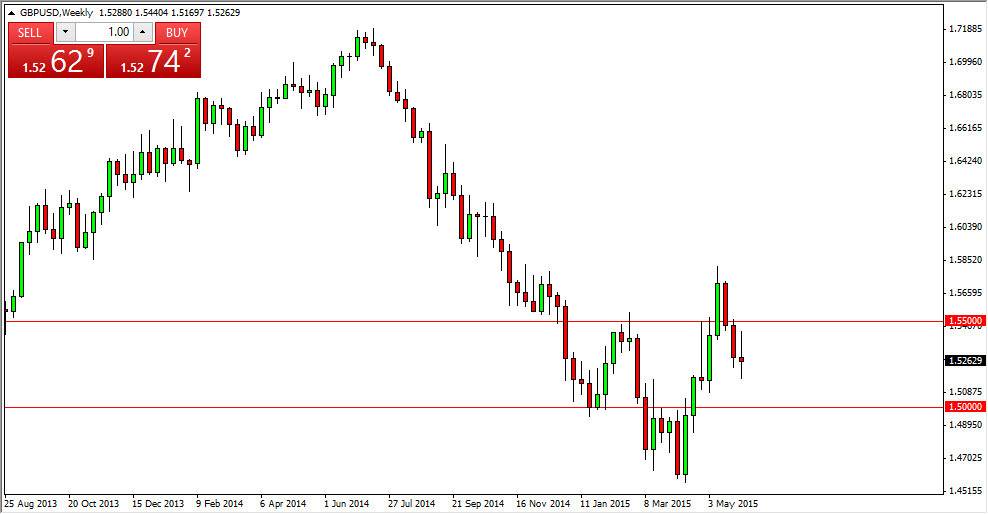

GBP/USD

The British pound had a very volatile week as well, as we continue to meander just above the 1.52 level, and test the 1.54 level for resistance. I personally believe based upon daily charts that we are more likely to go higher than lower, and as a result I am bullish. However, I am not looking for any type of massive move until we can clear the 1.55 level. At that point, we should test the 1.58 level, and then go much higher.

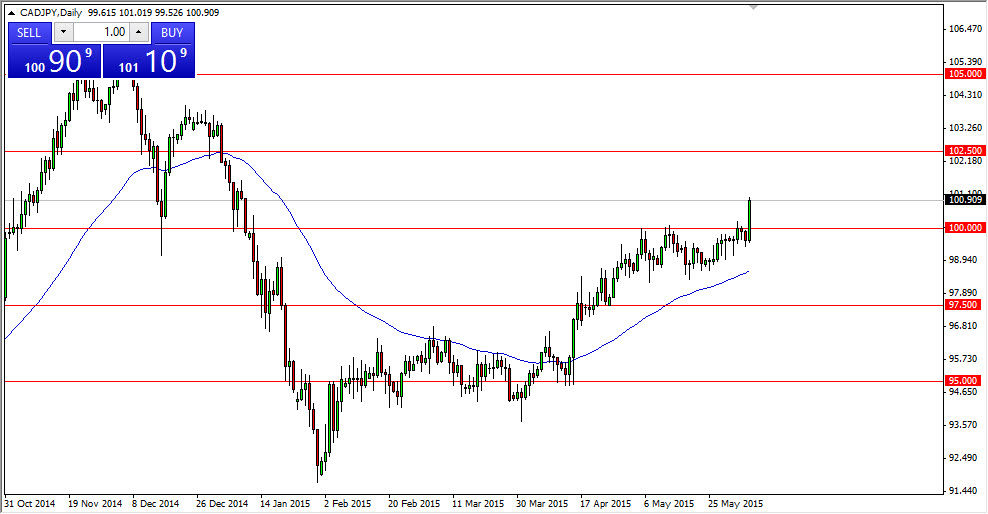

CAD/JPY

The Canadian dollar shown above the 100 level against the Japanese yen this past week, and has now broken out for a longer-term move higher. This trade is simple as far as I can see, I just simply going to buy every time it gets. I believe this is a long-term buy-and-hold type of situation and will continue to be for the foreseeable future.