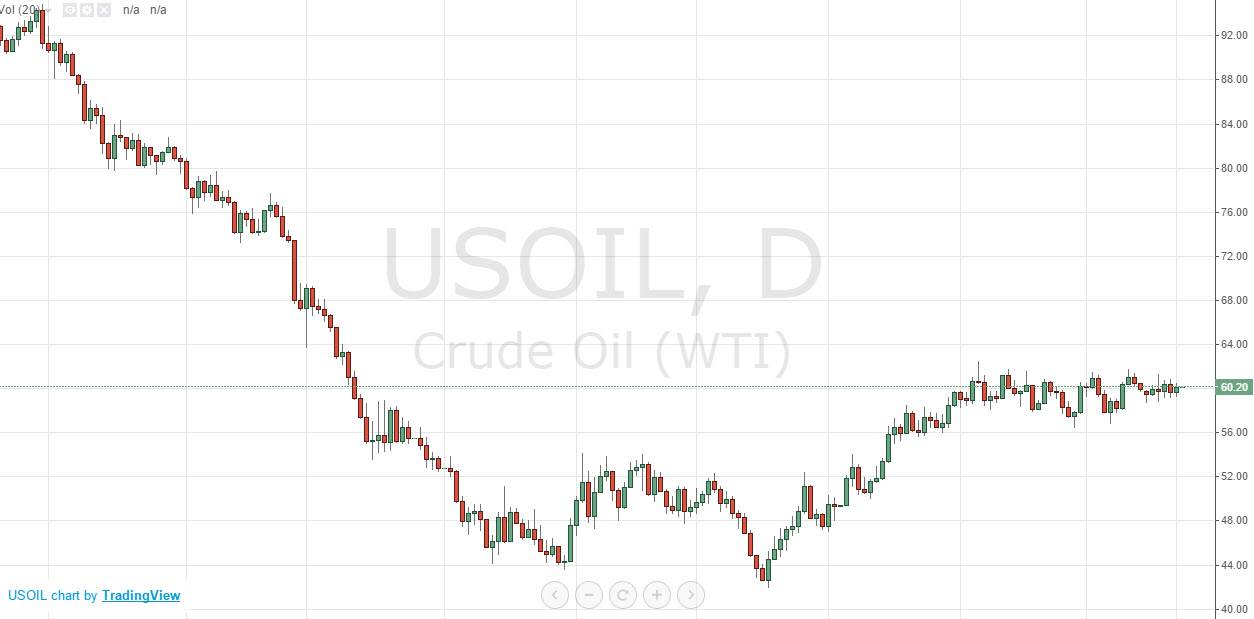

The WTI Crude Oil market rose slightly during the course of the session on Monday, as the $60 level continues to be a bit of an equilibrium in this market. Ultimately though, I am bullish of the oil markets but I recognize that we are essentially grinding sideways. At this moment in time, it looks like a market that is simply going to go back and forth, with the $57 level on the bottom and the $62 level on the top.

I think that until this market breaks out significantly in one direction or the other, you are eventually going to have to take short-term trades for short-term gains or losses. Some of you will choose to go back and forth but I feel that it’s much easier to simply buy this market as it looks like it has quite a bit of underlying bullishness. Once we get above the $62 level, I feel that the market will break out to $68, and then $76.

Summertime

Keep in mind that is the summertime, and as a result markets tend to go fairly sideways as a lot of the big money is actually sitting on the sidelines. I think that’s what’s going on right now, and as a result I am simply buying this market every time it dips with any significance. I have no interest in selling until we get below the $57 level low, as I feel that we have started to build a little bit of a base to go higher as the breakout above the $57 level was of course significant. That was once resistance, and it is now acting as support which of course is classic technical analysis.

With this, I believe that a lot of longer-term traders will start to “buy-and-hold this market, especially once we get above the $62 level, as it would show conviction and momentum to the upside as we continue to grind our way to much higher levels. Of course, what would help in this case would be a US Dollar Index falling which looks very possible at the moment.