The AUD/CHF pair is one of my favorite pairs when it comes to trading the macro environment around the world. Quite frankly, the Australian dollar is considered to be one of the “riskier” currencies around the world, while of course the Swiss franc is considered to be a “safety currency.” In other words, it’s easy to ascertain as to where risk appetite is when this pair is trending. Recently, we have seen a little bit of a bounce in this marketplace, but it has been just a small “blip on the radar” when it comes to the overall downward trend.

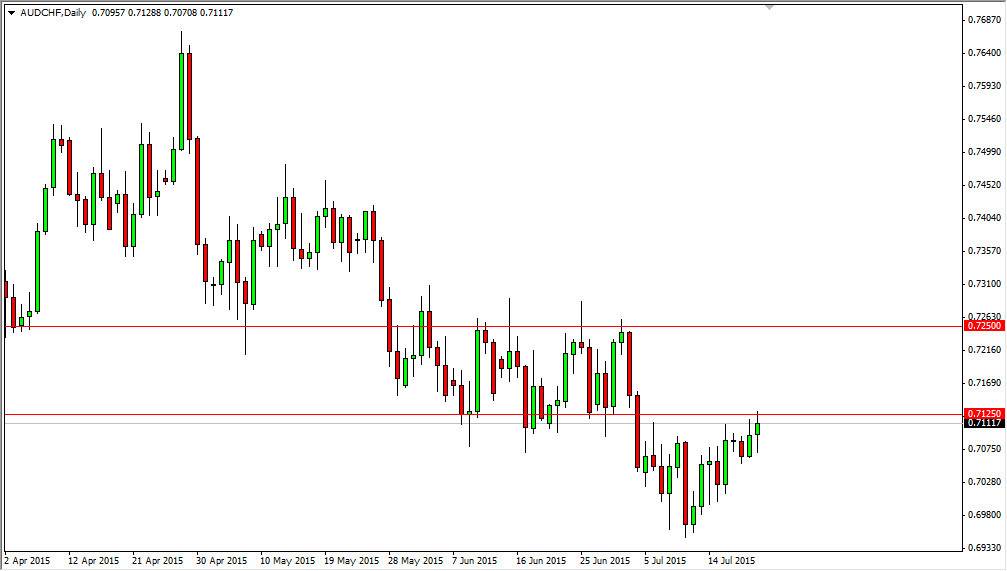

I think that the 0.7150 level or so should continue to offer resistance, and as a result I am looking for some type of resistive candle in order to start selling. After all, I do not like the Australian dollar in general, although I can’t necessarily suggest that the Swiss franc is a currency I want to own in general. In this particular case though, it makes sense.

Resistive candles offer selling opportunities

I believe that a resistant candle in this general vicinity should offer a selling opportunity as we will more than likely reach towards the 0.69 handle. The 0.69 handle should give way to selling pressure eventually, unless of course the macro situation around the world suddenly changes. I do not think it’s going to, and even though we have gotten past the Greek debt crisis for the time being, I feel that most market participants do not trust what happened, and believe that it’s only a matter of time before we start to have fear enter the market again.

Also, you have to watch the gold markets. They have been absolutely pummeled recently, and the Australian dollar will get dragged down eventually by such actions in that particular commodity. Also, above the 0.7125 level I see a significant amount of noise all the way to at least the 0.7250 handle. I am simply looking for resistive candles in order to get involved.