The AUD/NZD pair is one that can be rather choppy, but recently we have seen a significant move lower, and that of course means that the Australian dollar is going to continue to soften against most currencies in the world in relation. After all, the markets well more than likely punish most currencies that are related commodities anyways, and the fact that the gold markets have been so beat down recently, and quite frankly doesn’t surprise me that the Australian dollar suffers in comparison to the New Zealand dollar. Because of this, I think that we are starting to see the Kiwi dollar become “less bad” than the Aussie dollar.

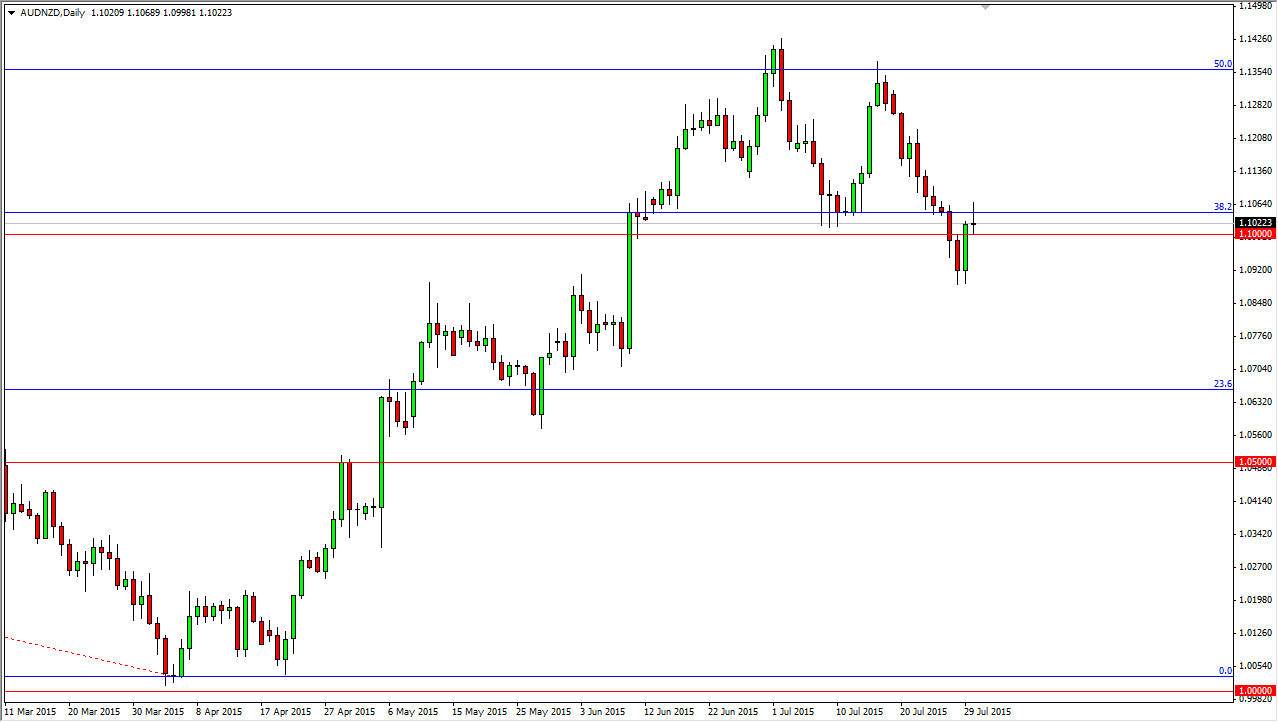

I like the fact that we formed a shooting star right at the 1.10 level, and that of course is a nice large, round, psychologically significant number. If we break down below the bottom of that shooting star, I will be a seller, which is basically below the 1.10 handle, and that we should head towards the 1.08 level next, and then eventually the 1.05 level. After all, gold looks like it’s got quite a ways to go, probably heading down to the 1000 level, and that of course should mean much lower Aussie in the near term.

Asia

Asia of course has a great influence on both of these currencies, but when you get a situation where demand for commodities falls in places like China and Southeast Asia, the reality is that New Zealand produces agricultural commodities, and those are needs, not wants. With fact, and construction slowing down, things like gold, iron, and copper will all fall in value as well. That’s another thing to think about, the copper markets look absolutely miserable at the moment, and that of course is more Australian and New Zealand anyways. As long as people eat, New Zealand will have sales in the export department, but Australia needs construction to get rid of all those minerals.

I suppose if we break the top of the shooting star, you could make an argument to head back to the 1.1350 level, but that won’t be a very easy trade to take in my opinion.