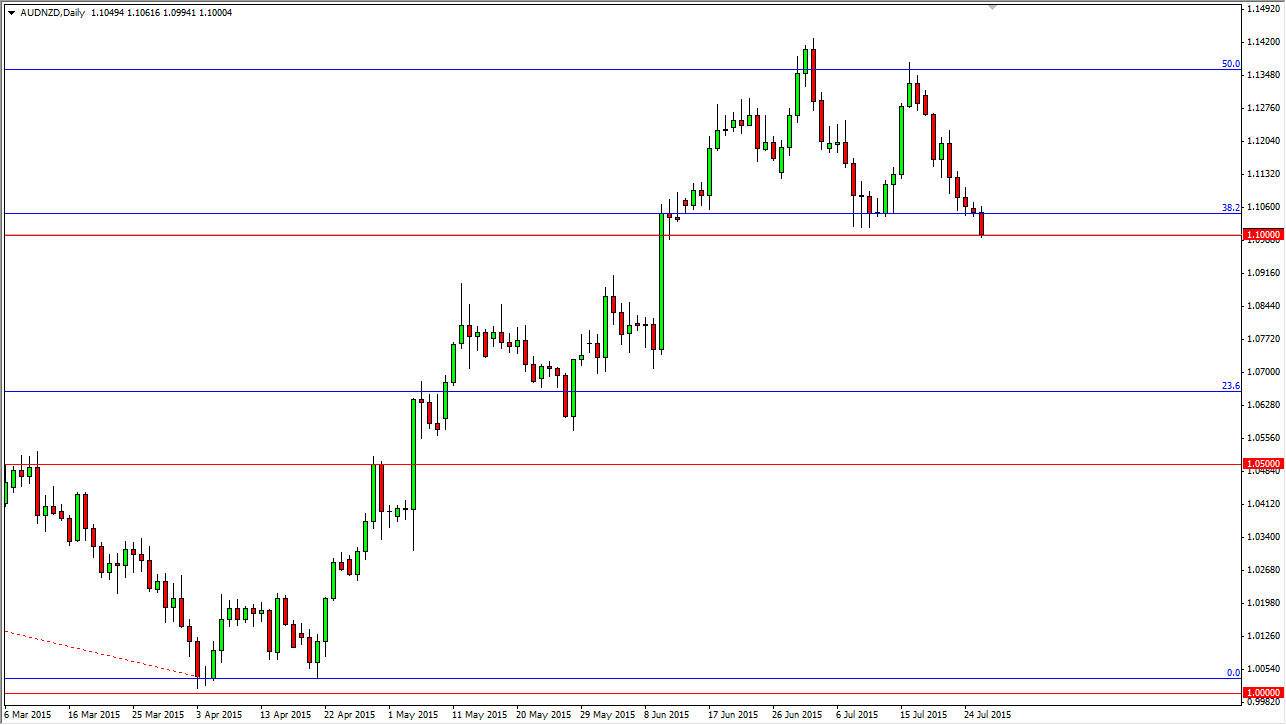

The AUD/NZD pair fell during the session on Monday, testing the 1.10 level. This of course is a large, round, psychologically significant number, and as a result I believe that if we can continue a little bit lower, the market will probably drop to the 1.0850 level. However, when you look at the larger charts, we recognize that the recent high that we had head was the 50% Fibonacci retracement level. In other words, it is possible that we continue to go much lower than that.

Both of these are commodity currencies, so this could be a bit of choppiness just waiting to happen. If we get this move though, I think this will probably be more indicative of what’s going on in the gold markets rather than the commodity markets in general. The Reserve Bank of New Zealand has recently had a cut in interest rates, and now it appears that perhaps the markets are anticipating the Reserve Bank of Australia doing the same thing.

Gold markets

Gold markets are in an absolute mess, and of course the Australian dollar continues to suffer. However, you have to look at relative strength when trading this pair. With this means is that the New Zealand dollar has been holding up “better” than the Australian dollar in general. This makes a lot of sense though, because the New Zealand economy exports mainly agricultural products. In other words, things people have to have. On the other hand, Australia tends to export hard commodities such as gold, iron, and other minerals. These are things that are used when construction is involved, and at this point in time construction seems to be slowing down in most Asian economies. In fact, with all of the destruction in the Shanghai markets, it could be suggested that perhaps there is more pain to come when it comes to Asia, which has a knock on effect to Australia. New Zealand will suffer as well, but again they have something people need and not something they want. There is a huge difference.