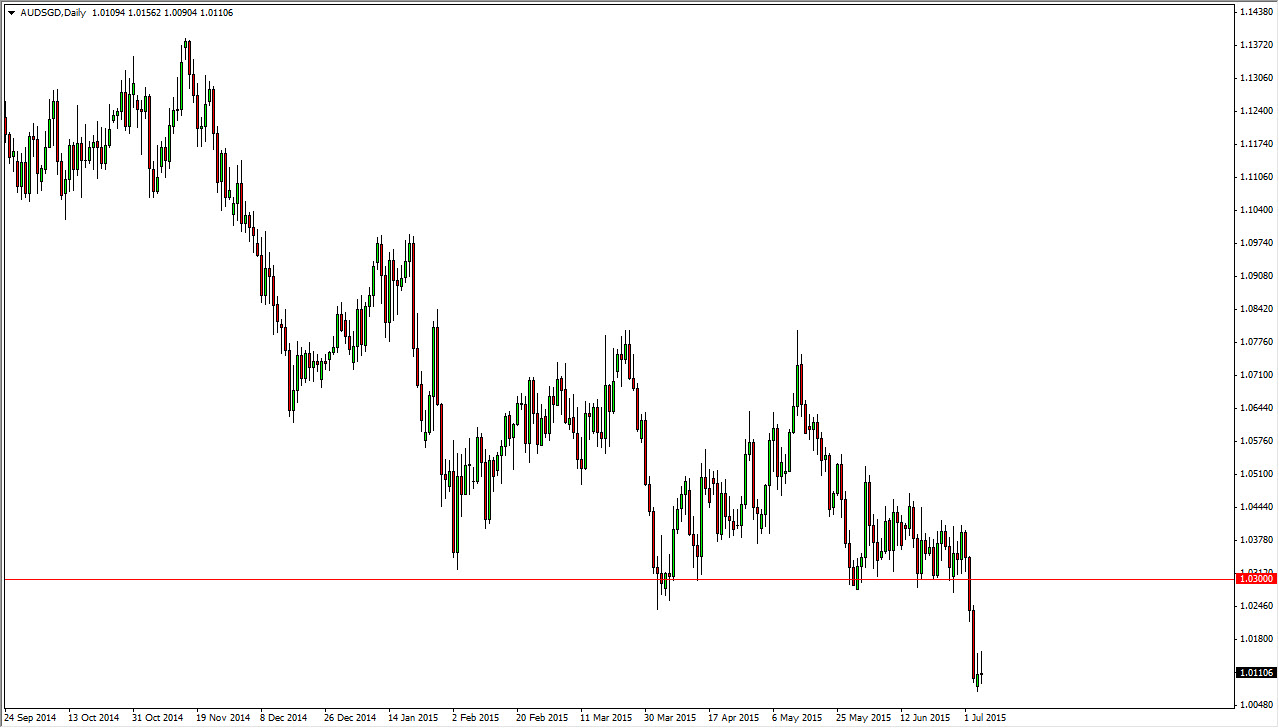

The AUD/SGD pair initially tried to rally during the session on Monday, but turned back around to form a shooting star. We currently find this pair at the 1.01 level, and as a result it’s probably only a matter of time before we start heading towards parity. The fact that we cannot rally for any real length of time in the Australian dollar shows just how negative this pair did become recently. The breaking below the 1.03 level of course was a bit of a “flush” in this particular market.

Looking at this pair, there’s really not much to stand in the way of parity, and as a result I believe that selling can be done almost right away. I would love to see a rally, because quite frankly it would offer “value” in the Singapore dollar, which as you may or may not know, is considered to be a bit of a “safety currency.”

Greece and Asia

Needless to say, the Greeks voting against the referendum sent shockwaves throughout the marketplace. This of course wears upon “risky” currencies, such as the Australian dollar. However, there is also the concern coming out of Asia as the Chinese economy slows down. That of course hurts Australian exports, and send money flowing from the Australian dollar. The Singapore dollar of course is a bit of a safety currency as stated before, so a lot of Asian traders probably are starting to throw money and Singapore itself.

The market looks like it’s ready to go to the parity level as it is the next large, round, psychologically significant number, and as a result I don’t see any reason why we don’t reach down there. I believe that rallies will offer selling opportunities, especially near the 1.03 handle as it should now be a massive resistance barrier as the area was so massive as far as support is concerned. The fact that we broke down there of course suggests that we are entering a fresh, new downward cycle.