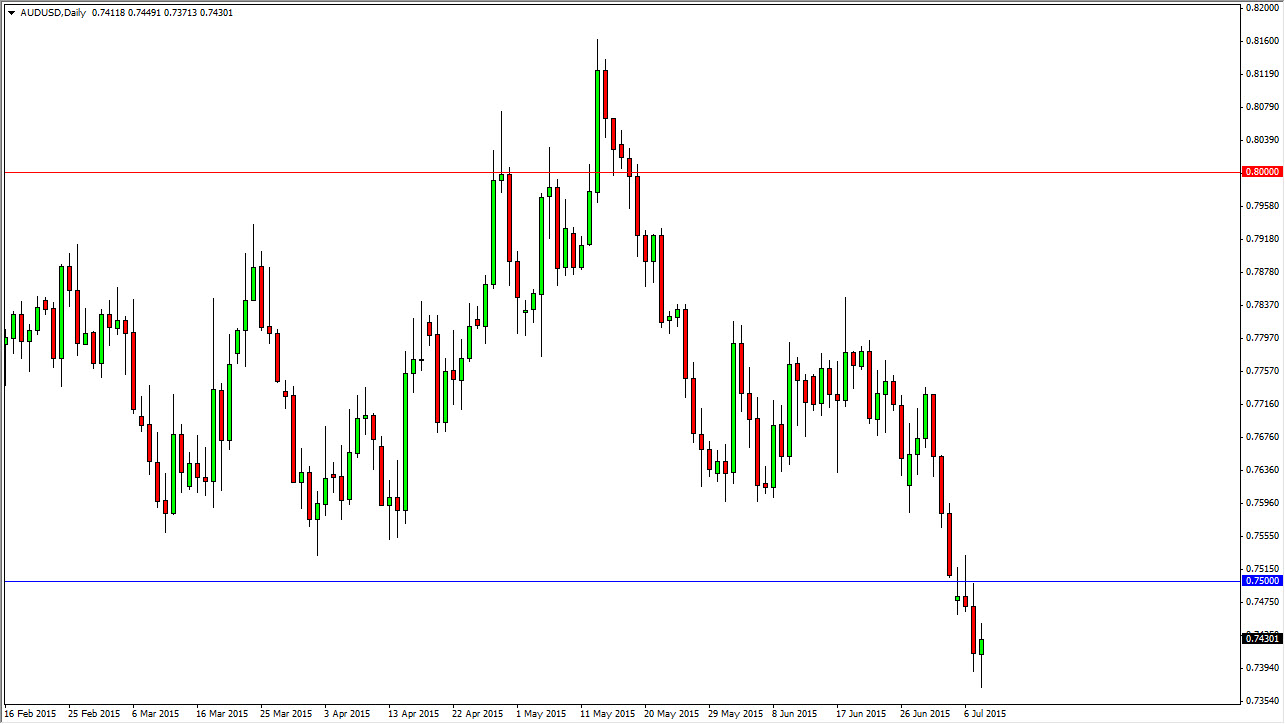

The AUD/USD pair initially fell during the day on Wednesday, but found support near the 0.7350 handle. In doing so, we actually could see a bit of a bounce from here as the market is a little bit overextended to the downside. However, the longer-term trend is most certainly to the downside, and as a result I still favor selling the Australian dollar. There are a lot of reasons to think that we will continue to go lower, not the least of which would be the slowdown in the Asian economies, specifically China.

I believe that the hammer is of course a very bullish sign, but I also recognize that the 0.75 level above is going to be resistive, as we have seen a shooting star form there recently. With that being the case, I believe that a rally from here offers selling opportunities near the 0.75 handle, but I also recognize that there is a significant barrier of resistance going all the way to the 0.76 handle. In other words, there are far too many things working against the Australian dollar technically for me to feel comfortable buying.

Gold isn’t helping either

Gold markets are basically a joke at this point, although they do look like the ready to bounce in the short-term. The gold markets broke down significantly a couple of sessions ago, and that of course will continue to put pressure on the Australian dollar itself. Remember, Forex traders tend to use the Australian dollar as a proxy for gold, and as a result that major reason to buy the Australian dollar is completely absent. On top of that, the US dollar continues to be favored in a situation that favors for the safety currencies, and should continue to do so as long as we have all the noise coming out of Greece. With this, I am bearish of this pair and believe that simply waiting for a rally to pick up “value” in the US dollar is the way to go.